Alkuperäinen keittiö- ja kylpyhuonealan valtavirran tiedotusvälineet keittiöstä ja kylpyhuoneesta

Korean suurimman kodinsisustusyrityksen ostosota kuumenee.

Lisättynä Korean vähittäiskaupan jättiläinen, LX Group, kilpailu Hanson Homen hankinnasta kiristyy. Aiemmin, Etelä-Korean Shinsegae-tavaratalo, Hyundai huonekalut (Hyundai Livart), Hyundai-tavaratalon tytäryhtiö, ja eteläkorealainen Lotte ilmoittivat aikovansa ostaa Hansonin yhdessä eteläkorealaisen pääomasijoitusyhtiön IMM PrivateEquityn kanssa. (IMM). Mutta hankintaleiri laajenee LXHausysin lisäämisen myötä, LX Groupin omistama rakennusmateriaaliyhtiö (kerran osa LG:tä), yksi Korean parhaista 50 yritysryhmiä.

Jos LX Hausys ostaa Hansenin, Sisustus- ja rakennusmateriaaliteollisuuden ykkösyritys, Korean rakennusmateriaali- ja sisustusteollisuuden maisema käy läpi valtavan muutoksen, ja huippuyritysten markkinaosuudet lasketaan uudelleen.

Korean median mukaan, LX Hausys piti hallituksen kokouksen syyskuussa 6 ja ilmoitti sijoittavansa 300 miljardia voittoa (RMB 1.7 miljardia) strategisena sijoittajana pääomarahastoon, jonka IMM aikoo perustaa ostaakseen Hansonin. kuitenkin, lopullista investointia ei ole vielä vahvistettu.

Lotte, Shinsegae ja Hyundai-tavarataloryhmä ovat ilmoittaneet suunnitelmistaan osallistua hankintaan. LX Hausysin katsotaan saavan eniten kilpailuetua, kun otetaan huomioon synergia Hansonin liiketoiminnan kanssa.

LX Groupin äskettäinen irtautuminen LG Groupista, sen toimiala on laajentunut perinteisistä rakennusmateriaaleista koko taloon. Rakennusmateriaalien osuus on noin 70% LX Hausysista’ myynti, peittää ikkunat, ovet, lattia, paneelit, keinotekoinen marmori, jne. Divisioonan myynti tämän vuoden toisella neljänneksellä oli KRW 659.6 miljardia, ylös 25% vuodesta toiseen. LX Hausysilla on suurin markkinaosuus kiinteistöprojektien ikkunakategoriassa Koreassa. Sillä on myös vahvuuksia korkean lisäarvon tuotelinjoissa, kuten marmorikeittiöallas ja PF-eristemateriaalit.

Ja Hansenilla on ylivoimainen etu Korean vähittäismarkkinoilla. Hansen aloitti keittiökalusteilla vuonna 1970, sitten alkoi toimittaa sisustushuonekaluja 1997 ja on laajentanut liiketoimintaansa rakennusmateriaaleihin, kuten kylpyhuoneisiin, ikkunat ja lattiat. Se on tällä hetkellä nro. 1 keittiökalusteiden ja sisustushuonekalujen markkinatoimija Koreassa. Sen ydinjälleenmyyjät, laadukkaat kaupat ja monet kaupat ovat tärkeimmät syyt houkutella ostajaa.

Korean tiedotusvälineiden mukaan, Hansenilla on näyttelytiloja ja megaelämyskeskuksia 15 tärkeimmät paikat alueella, mukaan lukien Bangbae-dong, Seocho-gu, Soul ja Nunhyeon-dong, Gangnam-gu, Daegu, Pangyo-dong, ja Hanam-si, Korea. He toimittavat yksinomaan Hansenin tuotteita ja ovat 550 verkkokaupat talon remontointia varten, 240 keittiökalusteliikkeet ja 80 lippulaiva sisustusliikkeet.

Hansen työllistää 8,000 saneerausrakennusalan ammattilaiset ja 2,500 sisustussuunnittelun myyjät. Yhtiön myynti viime vuonna (267.5 miljardia voittoa) yli nelinkertaistui edellisvuodesta (65 miljardia voittoa), paras suorituskyky sen perustamisen jälkeen. Sen online-kanava, Hansen Mall, joka tarjoaa tietoa uusien asuntojen mukauttamisesta, muuttavat talot, lastenhuoneita, jne., on saavuttanut positiivisen myynnin kasvun viime vuoden ensimmäisestä neljänneksestä lähtien. Tällä hetkellä se houkuttelee 3 miljoonaa asiakasta kuukaudessa.

Sen B2C myynti (remontti ja keittiö) jako kasvoi 23% vuodesta toiseen sisään 2020. Tästä, Järjestää jklle uusi asunto, joka tarjoaa kokonaisvaltaisia saneerausratkaisuja, kasvoi 33.3%. Alkaen 2020, Hansenin keittiömyynti käytettyihin asuntoihin on 27.5% kokonaismyynnistä. yhdistettynä 30.6 prosenttia online- ja offline-myynnistä huonekalujen ja kodin kalusteiden myynnistä, B2C-liiketoiminnan osuus 69.1 prosenttia.

Hansenin liikevaihto vuodelle 2020

| Tärkeimmät kirjanpitotiedot | 2020 | 2019 |

| Tulot | 2,067,469 | 1,698,372 |

| Bruttovoitto | 542,309 | 473,522 |

| Liikevoitto | 93,107 | 55,772 |

| Tulot ennen veroja | 95,490 | 74,459 |

| Nettotulon kasvu | 66,841 | 42,715 |

| Kokonaisvarallisuuden kasvu | 1,229,510 | 1,202,638 |

| Kokonaisvelkojen kasvu | 600,608 | 589,339 |

| Osakkeenomistajien kokonaismäärä | 628,902 | 613,299 |

| PITKÄ | 5.3% | 3.6% |

| ROE | 10.4% | 7.0% |

| Kokonaisvirtasuhde | 118.5% | 117.5% |

| Kokonaisvelkasuhde | 95.6% | 96.1% |

| Lainat ja maksettavat joukkovelkakirjat yhteensä | 5.4% | 5.6% |

| Osakekohtainen tulos | 3,766 | 2,423 |

| Osinko per osake | 1,300 | 1,200 |

Keittiön ja kylpyhuoneen tiedot julkisen tiedonkeruun mukaan

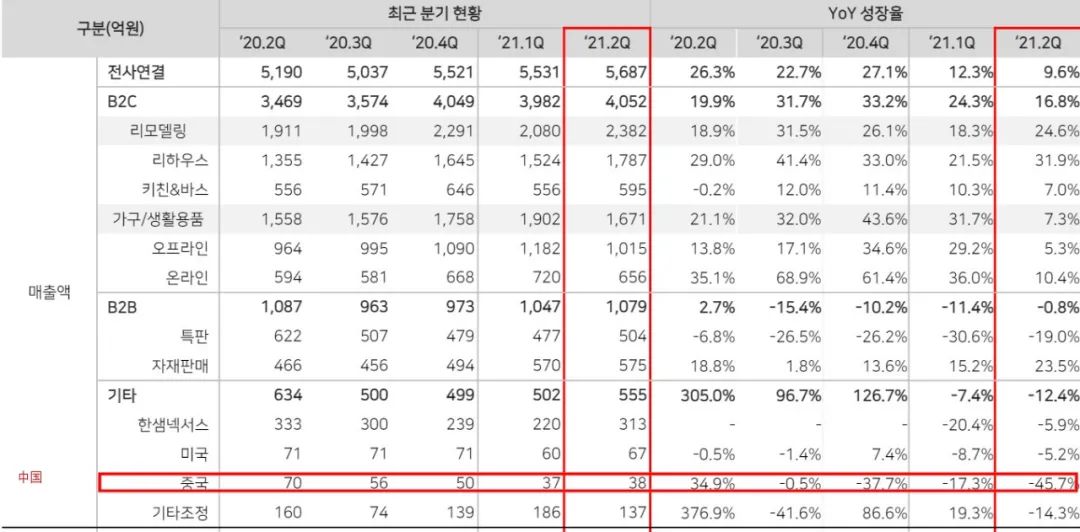

Vuoden toisella neljänneksellä 2021, liikevaihto ja liikevoitto kasvoivat 9.6 prosenttia ja 22.6 prosenttia, vastaavasti, verrattuna edelliseen vuoteen. Remodeling-segmentin myynti kasvoi 24.6 prosenttia vuositasolla.

Hansen 2021 ensimmäisen puoliajan tulokset

| Tärkeimmät kirjanpitotiedot | '20.2Q | '20.3Q | '20.4Q | 71.1K | *21.2K | Lisätä |

| Myynti | 5,190 | 5,037 | 5,521 | 5,531 | 5,687 | +9.6% |

| Liikevoitto

Voitto ennen veroja |

226 | 237 | 296 | 252 | 277 | +22.6% |

| 4.3% | 4.7% | 5.4% | 4.6% | 4.9% | +0.6%s | |

| Tilikauden voitto ja tappio

Tärkeimmät kirjanpitotiedot |

211 | 266 | 300 | 269 | 321 | +52.1% |

| 4.1% | 5.3% | 5.4% | 4.9% | 5.6% | +1.5%s | |

| Myynti | 145 | 190 | 203 | 196 | 243 | +67.6% |

| 2.8% | 3.8% | 3.7% | 3.6% | 4.3% | +1.5%s |

| Kanavat | '20.2Q | '20.3Q | '20.4Q | 71.1K | '21.2Q | Lisätä |

| Remodeling | 1,911 | 1,998 | 2,291 | 2,080 | 2,382 | +24.6% |

| Koti | 1,558 | 1,576 | 1,758 | 1,902 | 1,671 | +7.0% |

| B2B | 1,087 | 963 | 973 | 1,047 | 1,079 | -0.8% |

| muut | 634 | 500 | 499 | 502 | 555 | -12.4% |

Keittiön ja kylpyhuoneen tiedot julkisen tiedonkeruun mukaan

Koon kasvusta huolimatta, Hansenin ulkomaiset tytäryhtiöt eivät menestyneet odotetusti. Myynnin kasvu Hansenin Yhdysvalloissa. ja Kiinan tytäryhtiöt ovat myös hidastuneet joka vuosi viimeisen kolmen vuoden ajan. Viime vuonna, molempien tytäryhtiöiden myynti laski 10.2 prosenttia ja 3.9 prosenttia, vastaavasti, Kiinan tytäryhtiön pudotus oli kaksinumeroinen. Lasku jatkui myös tämän vuoden ensimmäisellä ja toisella neljänneksellä negatiivisella kasvulla 17.3 prosenttia ja 45.7 prosenttia.

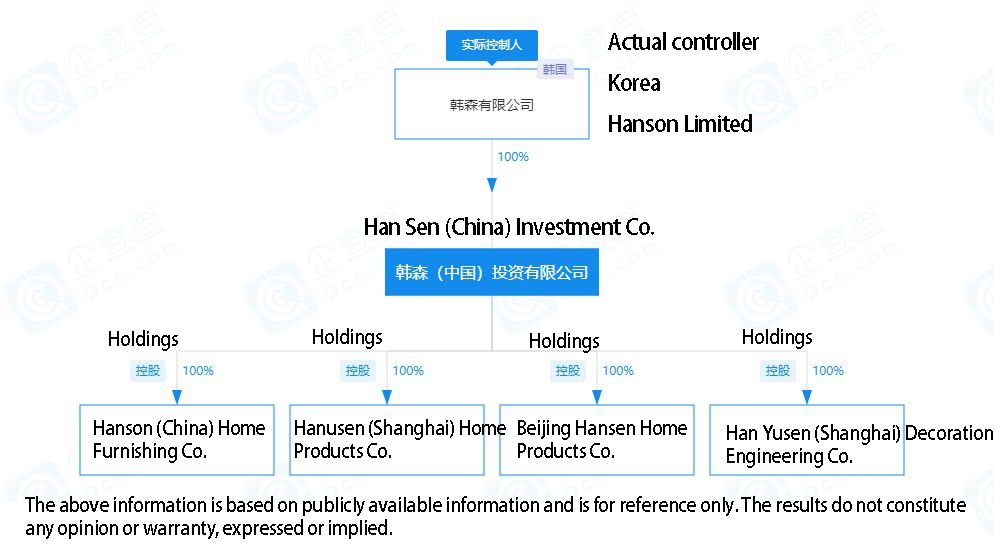

Hansen on ollut Kiinassa 1990-luvun alusta lähtien. Sisään 1995, se perusti Beijing Hansen Home Products Co., Oy. Pekingissä ja investoi kaapin tuotantolaitokseen toteuttaakseen suunnitteluliiketoimintaa, ja yhdessä kotitalousteollisuuden johtajan kanssa kehittääkseen joitain suunnitteluprojekteja.

Keittiön ja kylpyhuoneen tietokysely yrityshaussa havaitsi, että Beijing Hansen Home Products Co.:n osakkeenomistajat., Oy. Hansen (Kiina) Investment Co., Oy. korotti osakepääomaansa vuonna 2020, mutta tänä vuonna Beijing Hansen Home Products Co., Oy. helmikuussa laillinen edustaja, ohjaajat, osakkeenomistajille ja muille jäsenille peräkkäisistä muutoksista.

On syytä huomata, että aiemmin tänä vuonna tiedotusvälineissä kerrottiin, että suurin osa Kiinaan sijoittautuneen Hanson Korean korealaisista johtajista on vedetty pois peräkkäin vuoden lopussa. 2018 ja aikaisin 2019. Osa kiinalaisista työntekijöistä Kiinassa etsii seuraavaa kotiaan, ja jotkut ovat jopa löytäneet seuraavan kotinsa, odotettaessa vain merkittävän lomautuskorvauksen saapumista.

Aiemmin ilmoitettu sopimus IMM:n ostamisesta a 30.21% panos- ja hallintaoikeudet ovat kuulemma arvokkaita 1.5 triljoonaa voittoa (RMB 8.3 miljardia).

IMM arvioi Lotte’sin ja LX Hausysin’ investoinnit ja löytää yhteistyökumppanit jo syyskuun puolivälissä. Tällä hetkellä, Lotte on virallisesti ilmoittanut, että se on “osallistumista harkiten” ja LX Hausys on ilmoittanut sijoittavansa 300 miljardia voittoa strategisena sijoituksena. Hansonin hankinnan jälkeen, IMM aikoo kehittää siitä suurimman operaattorin online- ja offline-sisäkotimarkkinoilla.

iVIGA Tap Factory -toimittaja

iVIGA Tap Factory -toimittaja