Ụlọ ọrụ kichin na ime ụlọ ịsa ahụ Mainstream Media Kitchen and Bathroom News

U.S. A na-atụ anya na ahịa mmiri mmiri ga-eru $4.7 ijeri site 2028 A na-atụkwa anya na ọ ga-eto na CAGR nke 4.8% site na 2021 ka 2028, dịka nyocha nyocha na ahịa si kwuo.

Ọchịchọ maka ngwaahịa na ngwa ụlọ na-ebuwanye ahịa ahịa. Dabere na (Leading Indicator for Remodeling Activity) LIRA Center data, Mmefu mmezi ụlọ ga-eto na CAGR nke 6.0% n'ime 2019.

Ọchịchọ maka ụlọ smart na ndozi ụlọ ịsa ahụ mara mma na-ekpo ọkụ yana ọtụtụ ndị na-azụ ahịa na-egosi mmasị maka ahụmịhe spa n'ụlọ ha.. Na mgbakwunye, A na-eji nke nta nke nta amata ngwaahịa ndị na-eji atụmatụ nchekwa mmiri na teknụzụ dị ka faucets dijitalụ. The introduction of water-saving efficiency by the U.S. Environmental Protection Agency is also indirectly driving the growth in demand for smart bathroom equipment and digital faucets.

The tourism and hospitality industry has been hit hard by the COVID-19 pandemic, while the commercial market, which is closely linked to this segment, has also been affected. Agbanyeghị, it is estimated that the commercial segment will be the largest and fastest growing segment in the coming years. Many companies are offering premium and luxury faucets designed specifically for the commercial sector. Among international companies, faucet companies such as Moen and Delta are targeting a market growth and increasing the promotion of luxury faucets. And domestic, such as Jiangmen Jinn sanitary ware and other companies specializing in the manufacture of luxury and high-end faucets, are also targeting higher-end when. 2020 kitchen and bathroom information held on the “mining invisible champions, empowering the supply chain” mmeeme (ngwa ngwa njikọ: Revealing The “Inside Story” Of The Industry | Igwe mmiri ozuzo, Mgbapu ala, Igwe mmiri, Spools, Basin Downpipes Ihe Ndị Nnọchiteanya Azụmahịa kwuru), Jinn Sanitary Vice President Chen Xingwei said that the highest-end faucets have hand-carved faucets, umi, crystal, jade faucets, this part of the product is very popular in foreign markets.

Related links: what are the most valuable faucet brands in the U.S. market in 2019

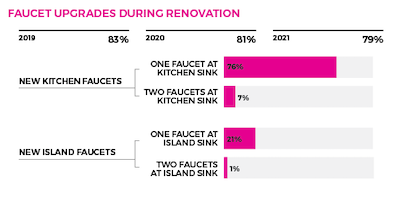

The kitchen segment is estimated to be the fastest growing. Increasing utilization of smart faucets is supporting the growth of this segment. According to Houzz, 57.0% of homeowners in North America are upgrading their kitchen faucets as part of a completed, ongoing, or planned 2018-19 kitchen renovation. Of those, 30.0% chose water-saving faucets, 24.0% chose fingerprint-free coated faucets and 22.0% preferred touch faucets. Na mgbakwunye, more and more people are using pull-down faucets for maximum use and increased flexibility.

Nsiputa: houzz

Also notable is the growth of female buyers. According to NPD, women are more likely to purchase kitchen and bathroom products than other home décor products. n'ime 2020, women will account for nearly 60 percent of the kitchen and bathroom product buying customer base online and 52 percent of offline sales.

E-commerce will account for 28% of total kitchen and bath improvement sales by 2020. Many home improvement retailers remained open during the pandemic, and consumers will visit home improvement stores more frequently once embargo restrictions are lifted. A greater percentage of these women are buying kitchen cabinets in offline stores and more showerhead and faucet combinations online.

This feature is also associated with an increase in female home ownership in 2020. According to the National Association of Realtors (NAR), single female buyers make up the highest 19% nke 2020 home buying population. The median age of single female repurchasers is 59 afọ. And while women 55 and older spend the most on annual kitchen and bathroom renovations, women 18 ka 24 have the largest increase in annual spending.

iVIGA Tap Factory Supplier

iVIGA Tap Factory Supplier