Original Kichen & Bad Kichen & Bad Schlagzeilen

Viru kuerzem, FBHS announced that it has completed the acquisition of Aqualisa Holdings (hereinafter referred to as Aqualisa) fir $160 Millioune (iwwer RMB 1.080 Milliarden). FBHS owns well-known bathroom brands such as Moen and ROHL. An der éischter Halschent vum Joer, its water innovation business had sales of $1.294 Milliarden (iwwer RMB 8.728 Milliarden). The acquisition will strengthen FBHS’s global presence in the sanitary industry.

Spending about 1.08 billion yuan to acquire a British bathroom company

Am August 1, lokal Zäit, FBHS announced that it has acquired Aqualisa, a British bathroom brand known for its innovative and intelligent shower systems and customer service. The acquisition was completed on July 29 fir ongeféier $160 Millioune (ongeféier RMB 1.080 Milliarden).

Nicholas Fink, CEO of FBHS, said the acquisition is a key strategy for the company in the water sector. As a member of the Water Innovation business, Aqualisa will enable the company to provide strong momentum in water management, connected products and global sustainability. Och, with the Aqualisa acquisition, FBHS’ Water Innovation business will gain access to digital shower products across price points, technologies and regions, fuert weider Geschäftswuesstem.

Nicholas Fink also said that Aqualisa is a great addition to the company’s bathroom brands such as Moen and ROHL. They will leverage strong marketing capabilities and a continuously growing water innovation platform to expand sales in the U.S., U.K. an Europa, and enter new markets in the future.

No ëffentlechen Informatiounen, Aqualisa was founded in 1976 and is a leading manufacturer of intelligent shower products. It has a strong reputation in the UK market for shower products manufactured and marketed primarily under the Aqualisa brand. Momentan, the company is headquartered in Westram, UK, and employs about 260 d'Leit. As previously reported, Aqualisa replaced its chief executive officer not long ago. Mat Norris has replaced Colin Sykes, who had held the position since 2018. The latter will continue to serve as a non-executive director and strategic advisor to the company.

Éischt Halschent Verkaf vun ongeféier $27.183 Milliarden

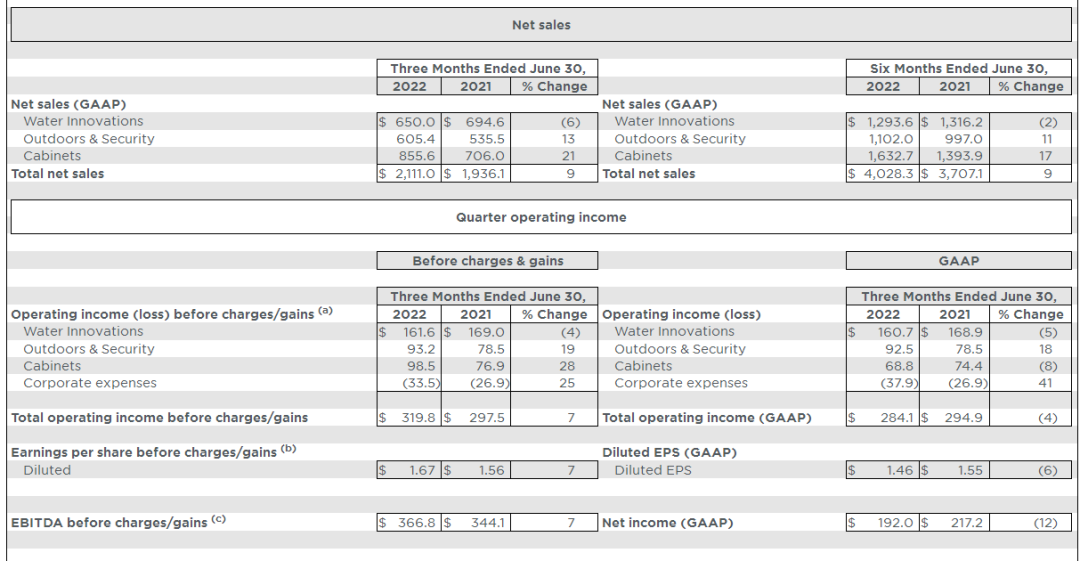

According to the recently released FBHS H1 2022 mellen, der Firma erreecht Ofsaz vun $4.028 Milliarden (ongeféier RMB 27.183 Milliarden) vu Januar bis Juni, eng Erhéijung vun 9% Joer zu Joer. Während der selwechter Period, FBHS’ EBITDA was $373 Millioune, a 6% decrease year-over-year.

By business, an der éischter Halschent vum Joer, sales of FBHS’ water innovation business (plumbing business) waren $1.294 Milliarden (ongeféier RMB 8.728 Milliarden), eng Ofsenkung vun 2% Joer-iwwer-Joer. Sales of the cabinet business, dorënner Buedzëmmer cabinets, waren $1.633 Milliarden (ongeféier RMB 11.014 Milliarden), eng Erhéijung vun 11% Joer-iwwer-Joer. Sales of outdoor and security products business were $1.102 Milliarden (iwwer RMB 7.432 Milliarden), eng Erhéijung vun 17% Joer zu Joer.

In its semi-annual report, FBHS mentioned price adjustment measures, saying that it delivered strong results in the second quarter as inflation was fully offset by price and cost-related measures. They also said that sales of outdoor and safety products and cabinet products all grew, driven by these measures. Allerdéngs, sales in the Water Innovations business declined 6 percent in the second quarter due to the impact of the outbreak-related shutdown in China, and when China is removed, Water Innovations sales had a 4 percent growth rate and an operating margin of approximately 24.9 Prozent.

A review of FBHS’s annual reports published since its IPO shows that the company’s sales have doubled in 10 Joer. An 2011, FBHS sales were $3.3 Milliarden, and have largely maintained a growth trend over the past 10 years since then. Dei ze 2021, FBHS sales reached $7.7 Milliarden, eng Erhéijung vun 26% vum Joer virdrun. Looking ahead to 2022, FBHS expects full-year sales growth to remain in the 6.5% zu 7.5% Gamme. Earnings per share are in the range of $6.36 zu $6.50.

Acquired more than 20 Firmen an 50 Joer

Als riseger Firma, although FBHS is not as well known in China as subsidiaries such as Moen and ROHL, the development of this company is a typical example of the growth of the home industry through acquisition. Et kann gesot ginn datt d'Geschicht vum FBHS eng Geschicht vu Mark Acquisitioun ass.

An 1970, the company acquired Master Lock, a security lock company.

An 1988, the acquisition of Aristokraft and Waterloo

An 1990, the acquisition of Moen

An 1998, acquired Decora, Diamant, Kemper, Schrock

An 2002, acquired Omega

An 2003, acquired American Lock, Therma-Tru doors

An 2007, acquired Simonton windows, Fypon millwork products

An 2011, listed on the New York Stock Exchange

An 2013, acquired Wood Crafters

An 2014, acquired Sentrysafe and sold Simonton windows

An 2015, acquired Norcraft, sold Waterloo

An 2016, acquired Riobel, Perrin & Rowe and established Global Plumbing Group (GPG)

An 2017, the acquisition of Shaws, Victoria + Albert

An 2018, the acquisition of Fiberon

An 2020, the acquisition of Larson storm doors

An 2022, the acquisition of Aqualisa

iVIGA Tap Factory Fournisseur

iVIGA Tap Factory Fournisseur