The takeover battle for Korea’s largest home furnishing company is heating up.

With the entry of Korean retail giant, LX ਸਮੂਹ, the takeover competition for HANSSEM Home is intensifying. ਪਹਿਲਾਂ, ਦੱਖਣੀ ਕੋਰੀਆ ਦਾ ਸ਼ਿਨਸੇਗੇ ਡਿਪਾਰਟਮੈਂਟ ਸਟੋਰ, Hyundai Livart, Hyundai ਡਿਪਾਰਟਮੈਂਟ ਸਟੋਰ ਦੀ ਇੱਕ ਸਹਾਇਕ ਕੰਪਨੀ, and Korea’s Lotte announced their intention to acquire HANSSEM in conjunction with South Korean private equity firm IMM PrivateEquity (ਆਈ.ਐਮ.ਐਮ), but with the addition of LXHausys, LX ਗਰੁੱਪ ਦੀ ਮਲਕੀਅਤ ਵਾਲੀ ਇੱਕ ਬਿਲਡਿੰਗ ਮਟੀਰੀਅਲ ਕੰਪਨੀ (ਇੱਕ ਵਾਰ LG ਦਾ ਹਿੱਸਾ), ਕੋਰੀਆ ਦੇ ਸਿਖਰ ਵਿੱਚੋਂ ਇੱਕ 50 ਕਾਰਪੋਰੇਟ ਗਰੁੱਪ, the takeover is expanding. The takeover camp is expanding.

If LX Hausys acquires HANSSEM, the number one company in the interior design and building materials industry, the landscape of the Korean building materials and interior design industry will be shaken up dramatically. The market share of the top players would be recalculated.

According to Korean media sources, LX Hausys held a board meeting on 6 September and announced that it would invest 300 ਅਰਬ ਜਿੱਤਿਆ (RMB 1.7 ਅਰਬ) as a strategic investor in a private equity fund that IMM plans to set up to acquire HANSSEM. ਹਾਲਾਂਕਿ, ਅੰਤਿਮ ਨਿਵੇਸ਼ ਦੀ ਅਜੇ ਪੁਸ਼ਟੀ ਨਹੀਂ ਹੋਈ ਹੈ.

ਲੋਟੇ, Shinsegae and Hyundai Department Store Group have already announced their plans to participate in the acquisition. LX Hausys is considered to have the most competitive advantage given the synergies with HANSSEM’s business.

With the recent divestment of LX Group from LG Group, its business scope has been expanded from traditional building materials to the whole house. Building materials account for approximately 70% LX Hausys ਦੇ’ ਵਿਕਰੀ, ਵਿੰਡੋਜ਼ ਨੂੰ ਢੱਕਣਾ, ਦਰਵਾਜ਼ੇ, ਫਲੋਰਿੰਗ, ਪੈਨਲ, artificial marble and more. The division recorded sales of KRW 659.6 billion in the second quarter of this year, ਉੱਪਰ 25% ਸਾਲ-ਦਰ-ਸਾਲ. LX Hausys ਕੋਲ ਕੋਰੀਆ ਵਿੱਚ ਰੀਅਲ ਅਸਟੇਟ ਪ੍ਰੋਜੈਕਟਾਂ ਲਈ ਵਿੰਡੋ ਸ਼੍ਰੇਣੀ ਵਿੱਚ ਸਭ ਤੋਂ ਵੱਧ ਮਾਰਕੀਟ ਸ਼ੇਅਰ ਹੈ. It also has strength in high value-added product lines such as marble kitchen sinks and PF insulation.

HANSSEM has an overwhelming presence in the Korean retail market, having started with kitchen furniture in 1970 and then interior furniture in 1997, and has now expanded its business to include building materials such as bathrooms, ਵਿੰਡੋਜ਼ ਅਤੇ ਫਲੋਰਿੰਗ. It is currently the number one market player in Korea in kitchen furniture and interior furniture. ਇਸ ਦੇ ਕੋਰ ਡੀਲਰ, quality shops and the number of shops are the most important reasons for attracting the acquirer.

ਕੋਰੀਆਈ ਮੀਡੀਆ ਰਿਪੋਰਟਾਂ ਦੇ ਅਨੁਸਾਰ, HANSSEM has showrooms and oversized experience centers in 15 key locations in the areas of Bangbae-dong, ਸੀਓਚੋ-ਗੁ, Seoul, Nunhyeon-dong, ਗੰਗਨਾਮ-ਗੁ, ਪੰਗਯੋ—ਡਾਂਗ, Daegu and Hanam-si, ਕੋਰੀਆ. HANSSEM products are exclusively available at these locations, as well as 550 online shops for re-house remodeling, 240 kitchen furniture shops and 80 flagship interior design shops.

HANSSEM employs 8,000 people specializing in remodeling and 2,500 in interior design sales. ਪਿਛਲੇ ਸਾਲ ਕੰਪਨੀ ਦੀ ਵਿਕਰੀ (267.5 billion KRW) ਪਿਛਲੇ ਸਾਲ ਨਾਲੋਂ ਚੌਗੁਣਾ ਵੱਧ ਹੈ (65 billion KRW), the highest result since its founding. ਇਸਦਾ ਔਨਲਾਈਨ ਚੈਨਲ ਹੈ, the HANSSEM Mall, ਜੋ ਨਵੇਂ ਘਰਾਂ ਨੂੰ ਅਨੁਕੂਲਿਤ ਕਰਨ ਬਾਰੇ ਜਾਣਕਾਰੀ ਪ੍ਰਦਾਨ ਕਰਦਾ ਹੈ, moving houses and children’s rooms, has seen positive sales growth since the first quarter of last year. ਇਹ ਵਰਤਮਾਨ ਵਿੱਚ ਆਕਰਸ਼ਿਤ ਕਰਦਾ ਹੈ 3 ਪ੍ਰਤੀ ਮਹੀਨਾ ਮਿਲੀਅਨ ਗਾਹਕ.

ਵਿੱਚ 2020, its B2C (remodeling and kitchens) division saw a 23% year-on-year increase in sales. ਇਸ ਦੇ, ਮੁੜ-ਘਰ, which offers total remodeling solutions, ਦੁਆਰਾ ਵਧਿਆ 33.3%. HANSSEM’s kitchen sales for second homes account for 27.5% of total sales by 2020. Together with the 30.6% of online and offline sales from the sale of furniture and home furnishings, the B2C business accounts for 69.1%.

|

HANSSEM’s Revenue for FY2020 |

||

| Key accounting data | 2020 | 2019 |

| ਮਾਲੀਆ | 2,067,469 | 1,698,372 |

| Gross profit | 542,309 | 473,522 |

| ਓਪਰੇਟਿੰਗ ਲਾਭ | 93,107 | 55,772 |

| ਟੈਕਸ ਤੋਂ ਪਹਿਲਾਂ ਆਮਦਨ | 95,490 | 74,459 |

| Net profit growth | 66,841 | 42,715 |

| ਕੁੱਲ ਸੰਪਤੀਆਂ ਵਿੱਚ ਵਾਧਾ | 1,229,510 | 1,202,638 |

| Increase in total liabilities | 600,608 | 589,339 |

| ਸ਼ੇਅਰਧਾਰਕਾਂ ਦੀ ਕੁੱਲ ਸੰਖਿਆ | 628,902 | 613,299 |

| ਲੰਬਾ | 5.3% | 3.6% |

| ਆਰ.ਓ.ਈ | 10.4% | 7.0% |

| Total current ratio | 118.5% | 117.5% |

| Total debt ratio | 95.6% | 96.1% |

| ਕੁੱਲ ਉਧਾਰ ਅਤੇ ਭੁਗਤਾਨਯੋਗ ਬਾਂਡ | 5.4% | 5.60% |

| Earnings per share Dividend per share | 3,766 | 2,423 |

| Compiled by Kitchen News from public data | 1,300 | 1,200 |

Kitchen and Bath Information based on public data

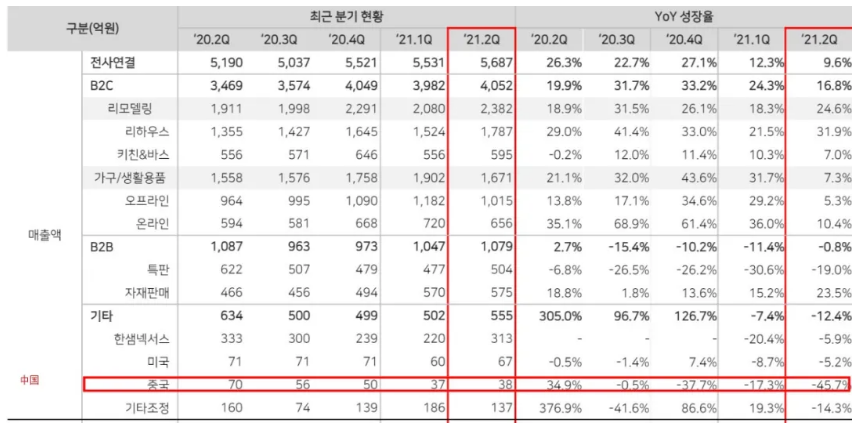

ਦੀ ਦੂਜੀ ਤਿਮਾਹੀ ਵਿੱਚ 2021, sales and operating profit increased by 9.6% ਅਤੇ 22.6% respectively compared to the previous year. Remodeling segment sales increased by 24.6 percent year on year.

|

HANSSEM’s Performance in the First Half of 2021 |

||||||

| ਮੁੱਖ ਲੇਖਾ ਡੇਟਾ | '20.2 ਪ੍ਰ | '20.3 ਪ੍ਰ | '20.4 ਪ੍ਰ | ‘21.1Q | '21.2 ਪ੍ਰ | ਵਾਧਾ |

| ਵਿਕਰੀ | 5,190 | 5 037 | 5,521 | 5 531 | 5 687 | +9.6% |

| Operating Profit

Profit Before Tax |

226 | 237 | 296 | 252 | 277 | +22.6% |

| 4.3% | 4.7% | 5.4% | 4.6% | 4.9% | +0.6%ਪੀ | |

| Profit And Loss For The Period | 211 | 266 | 300 | 269 | 321 | +52.1% |

| 4.1% | 5.3% | 5.4% | 4.9% | 5.6% | +1.5%ਪੀ | |

| ਵਾਧਾ

Remodelling |

145 | 190 | 203 | 196 | 243 | +67.6% |

| 2.8% | 3.8% | 3.7% | 3.6% | 4.3% | +1.5%ਪੀ | |

| ਘਰ | 1,911 | 1,998 | 2,291 | 2,080 | 2,382 | +24.6% |

| B2b | 1,558 | 1,576 | 1758 | 1 902 | 1 671 | +7.0% |

| Other | 1,087 | 963 | 973 | 1,047 | 1,079 | -0.8% |

| ਵਿਕਰੀ | 634 | 500 | 499 | 502 | 555 | -12.4% |

Kitchen and Bath Information based on public data

ਆਕਾਰ ਵਿਚ ਵਾਧੇ ਦੇ ਬਾਵਜੂਦ, HANSSEM’s overseas subsidiaries have not been as successful. The sales growth rates of HANSSEM’s US and Chinese subsidiaries have also slowed down each year for the past three years. ਪਿਛਲੇ ਸਾਲ, sales of the two subsidiaries fell by 10.2% ਅਤੇ 3.9% ਕ੍ਰਮਵਾਰ, while the Chinese subsidiary experienced a double-digit decline. The decline continued in the first and second quarters of this year as well with negative growth of 17.3% ਅਤੇ 45.7%.

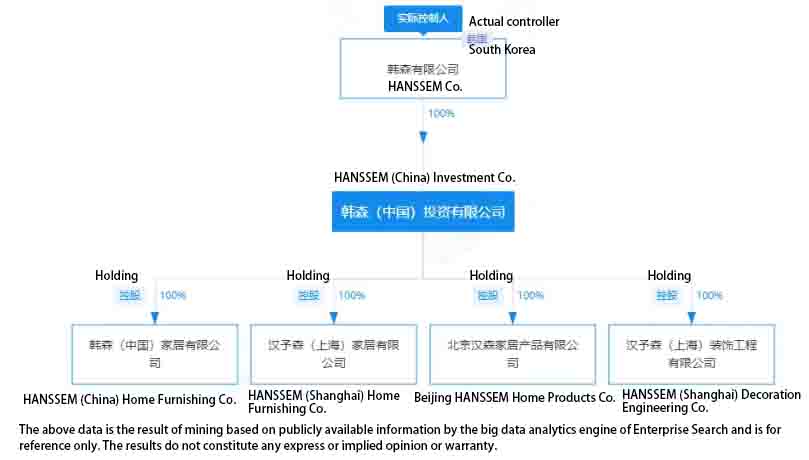

HANSSEM was already present in China in the early 1990s when it established Beijing HANSSEM Home Products Co Ltd and invested in a cabinet manufacturing plant in Beijing in 1995. It undertakes engineering business and has joined forces with headline companies in the pan-home furnishing industry to develop some engineering projects.

It was found that the shareholder of Beijing HANSSEM Home Products Co Ltd, Hanssem (ਚੀਨ) Investment Co Ltd, had increased its registered capital in 2020, but this year Beijing HANSSEM Home Products Co Ltd had a succession of changes in legal representatives, ਨਿਰਦੇਸ਼ਕ, shareholders and other members in February.

It is worth noting that earlier this year there have been media reports that most of the Korean executives of HANSSEM stationed in China have been withdrawn one after another in late 2018 ਅਤੇ ਛੇਤੀ 2019. Some of the Chinese employees of Chinese origin are looking for their next homes, and some have even already found their next homes. They are only awaiting the arrival of significant redundancy compensation.

IMM ਨੂੰ ਹਾਸਲ ਕਰਨ ਲਈ ਪਹਿਲਾਂ ਐਲਾਨ ਕੀਤਾ ਸੌਦਾ ਏ 30.21% ਹਿੱਸੇਦਾਰੀ ਅਤੇ ਪ੍ਰਬੰਧਨ ਅਧਿਕਾਰ ਕਥਿਤ ਤੌਰ 'ਤੇ ਕੀਮਤੀ ਹਨ 1.5 ਟ੍ਰਿਲੀਅਨ ਜਿੱਤਿਆ (RMB 8.3 ਅਰਬ).

IMM Lotte's ਅਤੇ LX Hausys ਦੀ ਸਮੀਖਿਆ ਕਰੇਗਾ’ investment and identify a partner as early as mid-September. ਵਰਤਮਾਨ ਵਿੱਚ, ਲੋਟੇ ਨੇ ਅਧਿਕਾਰਤ ਤੌਰ 'ਤੇ ਐਲਾਨ ਕੀਤਾ ਹੈ ਕਿ ਇਹ ਹੈ “ਭਾਗੀਦਾਰੀ 'ਤੇ ਵਿਚਾਰ ਕਰਦੇ ਹੋਏ” ਅਤੇ ਐਲਐਕਸ ਹਾਉਸੀਸ ਨੇ ਘੋਸ਼ਣਾ ਕੀਤੀ ਹੈ ਕਿ ਇਹ ਨਿਵੇਸ਼ ਕਰੇਗਾ 300 billion KRW as a strategic investment. Following the completion of the acquisition of HANSSEM, IMM ਇਸ ਨੂੰ ਔਨਲਾਈਨ ਅਤੇ ਔਫਲਾਈਨ ਇਨਡੋਰ ਹੋਮ ਮਾਰਕੀਟ ਵਿੱਚ ਸਭ ਤੋਂ ਵੱਡੇ ਆਪਰੇਟਰ ਵਜੋਂ ਵਿਕਸਤ ਕਰਨ ਦੀ ਉਮੀਦ ਕਰਦਾ ਹੈ.

iVIGA ਟੈਪ ਫੈਕਟਰੀ ਸਪਲਾਇਰ

iVIGA ਟੈਪ ਫੈਕਟਰੀ ਸਪਲਾਇਰ