Индустрија кухиње и купатила Маинстреам медији Информације о кухињи и купатилу

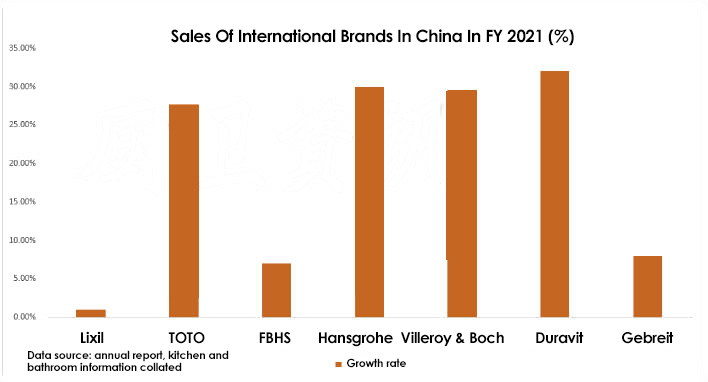

International brands’ annual sales situation in 2021 is out. According to the statistical analysis of Kitchen & Батх Информатион, most brands like Lixil maintained growth of about 20% in sales in mainland China last year, but there is also some weak growth.

ТОТО

Grew 28% у Кини

Sinking into second and third-tier cities

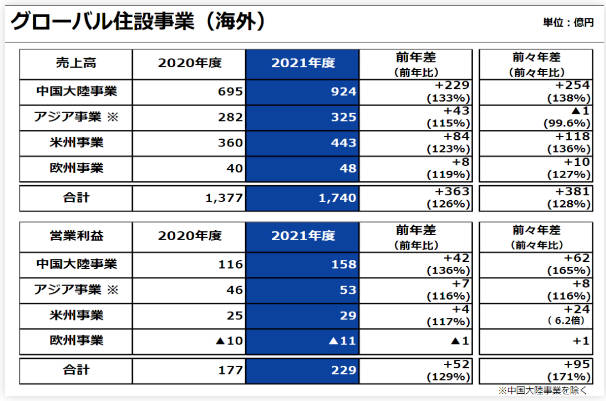

According to TOTO’s fiscal year 2021 извештај, компанија је остварила продају од 645.3 трилиона јена (РМБ 32.7 милијарди) during the period from April 2021 до марта 2022, ан 11.7% increase year-on-year. It reported an operating profit of 52.2 трилиона јена (РМБ 2.6 милијарди), горе 31.6% из године у годину. Обична добит је била 56.9 трилиона јена (РМБ 2.9 милијарди), повећање од 38.6% из године у годину. Нето приход који се приписује акционарима матичне компаније је био 40.1 трилиона јена (РМБ 2 милијарди), повећање од 48.8% из године у годину.

Од овога, revenue in mainland China for fiscal 2021 био 92.4 трилиона јена (РМБ 4.7 милијарди), повећање од 33% из године у годину. It posted an operating profit of 15.8 трилиона јена (РМБ 807 милиона), горе 36% из године у годину. With the addition of Taiwan operations in China, TOTO’s total revenue in China was 5.677 милијарди јуана (in RMB), повећање од 28% из године у годину.

From January to December 2021, TOTO achieved sales of RMB 5.398 billion and operating profit of RMB 1.057 billion in mainland China, both up 21% из године у годину.

Према извештају, TOTO’s sales in mainland China contributed the majority of results in the East China region, рачуноводство за 42%, followed by South China (24%), North China (20%) and Midwest (14%). All regions achieved sales growth, with the North China market growing by 29%. На страни производа, sales in the three categories of sanitary ceramics, санитарије, and faucet hardware increased 21%, 22%, и 21% године у односу на претходну годину, although the increase was narrower than in fiscal 2019.

TOTO’s previously released medium-term plan promotes the expansion of high value-added products into China’s second and third-tier cities, leveraging the strength of the TOTO Sanitary Ware luxury brand and strengthening the promotion of Sanitary Ware. According to TOTO Sanitary’s sales data, продаја у 2020 и 2021 расла по 11% и 39% редом, користећи 2019 sales as the base. Међутим, прве четвртине 2022 sales just passed was only 77% of the same period of the previous year.

In other markets, the Americas and Europe achieved sales growth. The smart toilet market in the U.S. exploded. Sales of Toilet Bowl increased by 96% преко 2019, and sales increased by 85% преко 2019. It became the main driver of sales and profit growth in TOTO’s U.S. тржиште.

LIXIL China

Grohe growth, American Standard weakness

Engineering shifts to retail and e-commerce

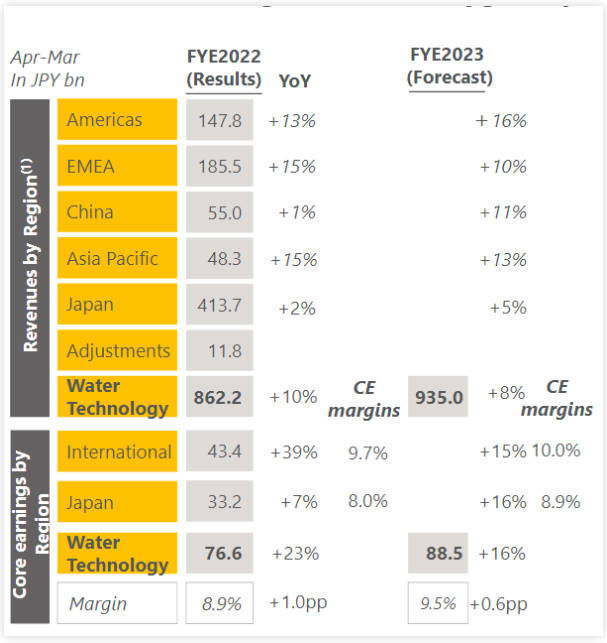

Према Ликил‘s fiscal 2021 annual report released on April 28, core earnings were below full-year expectations, even with continued strong sales in the Americas and Europe and an economic rebound in Asia Pacific, as the Japanese business was impacted by procurement difficulties and logistics disruptions. The company achieved revenue of ¥1,248.6 billion ($73 милијарди) for the period from April 2021 до марта 2022. It posted an operating profit of 64.9 трилиона јена, горе 13.2% из године у годину. It included final net income from discontinued operations of 48.6 трилиона јена, повећање од 47.1% из године у годину.

Посебно, the China Water Technology Division reported revenues of 55 трилиона јена (2.807 милијарди јуана), повећање од 1% из године у годину. Sales growth was driven by Grohe products in the retail channel.

Both Grohe and American Standard subsidiaries recorded growth in sales and operating profit in fiscal 2021, with Grohe Group revenues of 1.776 трилиона евра (РМБ 12.5 милијарди), повећање од 18 процената. Its operating profit was 252 милиона евра (1.775 милијарди јуана), повећање од 32%. АСБ (АСД Холдингс), подружница Америцан Стандарда, posted revenues of $1.408 милијарди (РМБ 9.396 милијарди), повећање од 13%. Its operating profit was $77 милиона (РМБ 510 милиона), повећање од 14%.

It is worth noting that in FY 2021 Lixil added 300 милиона јена (РМБ 153.6 милијарди) in spending on IT only to its capital expenditures.

Додатно, at the earnings presentation, Lixil Group President and CEO Kinya Seto was asked by reporters how he sees the current real estate situation in the Chinese business, and his statement was as follows:

The most number of price transmissions in the Americas business. Опет, competitors are doing the same, so I don’t think price pass-through itself will affect demand. Међутим, Lixil Americas’ faucet business is the weakest of all the international businesses, but the ceramics business in the Americas is very strong. We want to strengthen our faucet business, especially for showers. У том погледу, we are able to use zinc materials. And our competitors are currently focused on brass and copper, which can improve our cost advantage. As for ceramics, I think the optimization of prices will be done in much the same way as the others. У исто време, I believe the real estate market may be affected by the increase in mortgage rates, but this effect will not have an immediate effect. Додатно, there is currently a large demand for renovations and improved improvements in the US. If there is a bad situation in the real estate market, does it seriously affect our business? We do not believe this is necessarily the case. У овом тренутку, based on the orders received, we think the situation has been relatively stable so far. наравно, regarding the future, now that the U.S. is raising interest rates more and more often, this change cannot be foreseen. As for the China business, I think there are still risks, so we are trying to reduce the size of each business unit by moving from engineering projects to retail and from engineering projects to e-commerce. This will be a resilient result of the transition, although it may not show bright results in the short term. У међувремену, Grohe’s China market business is performing well. I think Grohe has been recognized by end users as a good product and brand in the China market, and the design and brand recognition are spreading. С друге стране, American Standard brand products, which have been relatively strong in the original engineering business, are struggling a bit.

Виллерои & Боцх

China market grows 29.6%

Виллерои & Boch’s consolidated revenue reached €945 million in 2021, повећање од 18% из године у годину. The Bathroom & Wellness segment generated revenues of 22.3 милиона евра, горе 16.8 % из године у годину, while the Tableware & Lifestyle segment generated revenues of 20.9 милиона евра, горе 20.6 % из године у годину. EBIT revenues were 92.8 милиона евра, горе 87% из године у годину.

EMEA’s sales in Europe, Middle East and Africa increased by 17.2%, with revenues in the Middle East of €7.7 million. Its revenue in Europe was 103 милиона евра, горе 16.3% из године у годину. Its sales in China increased by 29.6% and in the United States by 27.7%.

In its announcement, Виллерои & Boch noted that it benefited from digital marketing with the launch of its TV and online brand campaign “Love The Moment” for the European market in 2021. Додатно, it is optimizing traditional marketing channels by expanding e-commerce channels and digital marketing through social media platforms such as Instagram and Pinterest, as well as newsletters.

FBHS Group’s

China’s market grows 7%

Focus on international business for brands such as Jiumu and Huida

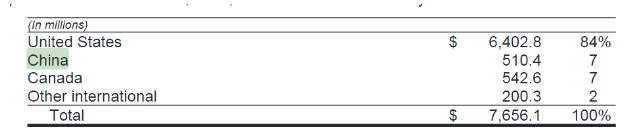

FBHS Group reported consolidated revenue of $7.7 милијарди (РМБ 513.8) ин 2021, повећање од 26% из године у годину. It reported an operating profit of $1.1 милијарди (РМБ 7.34 милијарди), горе 36% године у односу на претходну годину.

For the year ended December 31, 2021, the FBHS Group’s China revenue was $510.4 милиона (РМБ 3.37 милијарди), горе 7% године у односу на претходну годину. ФБХС’ plumbing business operates primarily under the Moen, РОХЛ, Риобел, Victoria+Albert, Перрин & Rowe and Shaws brands. The majority of its operations are in the United States, China and Canada, with the remainder in Mexico, југоисточна Азија, Europe and South America.

Ин 2021, its international operations accounted for 32% нето продаје, primarily to wholesalers, home centers, large retailers and industrial distributors. Home Depot and Lloyd’s sales represent approximately 21 percent of 2021 net sales in the plumbing segment. Key competitors in this segment include Masco, Кохлер, Ликил, ИнСинкЕратор, Лет, Hgill, JOMOO and imported private brands.

Хансгрохе

China’s market revenue of more than 2 милијарди јуана

Акор (Акор) brand China performance than Germany

Ин 2021, the Hansgrohe Group achieved total revenues of 1.365 трилиона евра (9.528 милијарди јуана), повећање од 27% у односу на претходну годину (1.074 трилиона евра). It posted an operating profit of €249.7 million (РМБ 1.76 милијарди), also up 27% у односу на претходну годину (€197 million). Revenue from overseas markets reached 74%, горе 1%. Revenue in Germany was €349 million (РМБ 2.435 милијарди), горе 20 percent compared to 2020 (€291 million). The market outside Germany grew by nearly 30%.

Strong sales in China and the United States, Акор (Акор) last year in the Chinese market for the first time than the German market business. Hansgrohe’s China revenue exceeded 2.3 милијарди РМБ, according to Kitchen & Bath analysis.

То је трајало

China’s revenue exceeded 1 милијарди

Chongqing invests another 300 милиона јуана

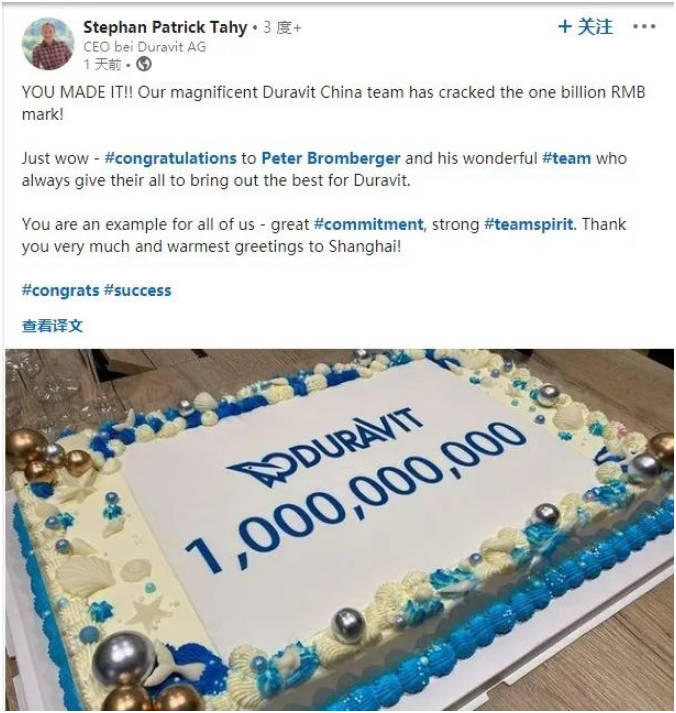

Duravit Group sales exceeded 600 million euros for the first time in fiscal 2021, достизање 601 милиона евра, повећање од 28%. Пословање у Европи и Кини је наставило да расте. Продаја у Кини износила је приближно 139 милиона евра. Према саопштењу генералног директора Дуравит АГ, sales in China reached RMB 1 billion by the end of December 2021.

Овај снимак екрана је снимак поруке Колажа директора Дуравит АГ из Китцхен Невс-а у децембру 1, 2021

Ин 2022, Duravit signed a contract with Chongqing to invest another 300 милиона РМБ. It is reported that the second phase of the expansion project is expected to be built from 2022 да 2024. The project will increase the annual production capacity of 700,000 pieces of high-grade sanitary ceramic sanitary ware upon completion. The combined annual production capacity with the first phase of the project can reach 1.45 милиона комада. Ин 2022, it’s planned to invest 147 million yuan and complete about 50% of the plant construction.

The project covers an area of 87 mu and is the second phase of expansion. After completion, the Jiangjin Luohuan base will be the largest overseas production base invested by Duravit since its establishment, and the largest overseas investment project since Duravit was founded nearly 200 године пре.

Геберит

China’s market growth of 8%

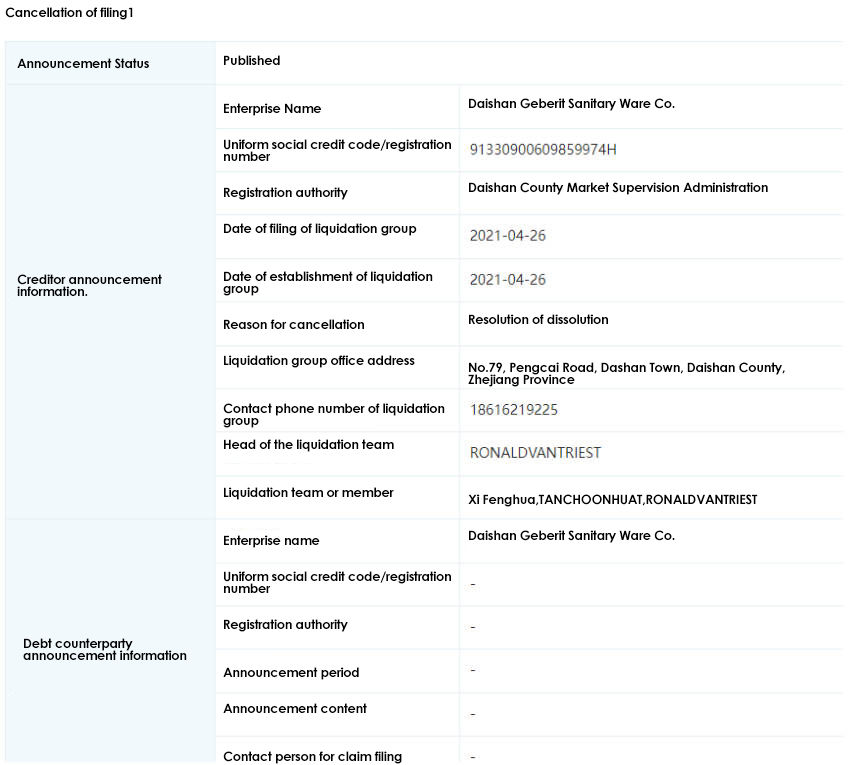

Zhejiang plant shut down and written off

Gebreit reported net sales of CHF 3.46 милијарди (РМБ 23.5 милијарди) у фискалној 2021, повећање од 15.9%. EBITDA was CHF 1.069 милијарди, повећање од 15.6%. Significant increases in raw material prices since the end of 2020, as well as significant increases in energy and freight costs, have had a negative impact on margins. These negative effects were partially offset by regular and unconventional price increases. The partial normalization of marketing costs compared to the previous year also weakened the result. Currency effects did not have a significant impact on operating margins. The growth in operating results and the improved financial performance led to a 17.7% increase in net profit to CHF 756 милиона.

Growth in China was 8.0%, slightly above the average of the previous years and much stronger than in the previous year (+2.3%). There was no growth in Tier 1 и Тиер 2 градова. And Tier 3 и Тиер 4 cities also saw declines, with prices falling.

Gebreit had 26 plants worldwide during the reporting period, од којих 22 were located in Europe, 2 у Сједињеним Државама, 1 in China and 1 in India. It is worth noting that in 2021 Zhejiang Daishan Gebreit Co., доо. resolved to dissolve and implemented liquidation in April of the same year, and is currently in the process of cancellation. In its annual report, Gebreit also mentions the restructuring of its Chinese plants: three small plants located in the territory of China, the United States and Ukraine, whose activities were consolidated in other larger plants due to a lack of scale and the existence of poor logistics conditions. Daishan Gebreit was established on July 9, 1996, са 156 participants according to the enterprise search information, and mainly produced and sold plastic water tanks and other related sanitary products. After the closure, part of the factory’s operations were integrated into the Shanghai factory, and the rest of the operations were integrated into the European factory.

иВИГА Тап Фацтори добављач

иВИГА Тап Фацтори добављач