Jikoni ya asili na tasnia ya bafuni kuu ya media jikoni na habari ya bafuni

The acquisition war for Korea’s largest home furnishing company is heating up.

With the addition of Korean retail giant, Kikundi cha LX, the competition for the acquisition of Hanson Home is intensifying. Hapo awali, Duka la Idara ya Shinsegae ya Korea Kusini, Hyundai Furniture (Hyundai Livart), ruzuku ya Duka la Idara ya Hyundai, and South Korea’s Lotte announced their intention to jointly acquire Hanson with South Korea’s private equity IMM PrivateEquity (Imm). But the acquisition camp is expanding with the addition of LXHausys, Kampuni ya vifaa vya ujenzi inayomilikiwa na LX Group (Mara moja sehemu ya LG), Moja ya juu ya Korea 50 vikundi vya ushirika.

If LX Hausys acquires Hansen, the top-ranked company in the interior design and building materials industry, the landscape of the Korean building materials and interior design industry will undergo a huge shakeup, and the market shares of the top companies will be recalculated.

Kulingana na vyombo vya habari vya Korea, LX Hausys held a board meeting on September 6 and announced that it will invest 300 bilioni alishinda (RMB 1.7 bilioni) as a strategic investor in a private equity fund that IMM plans to set up to acquire Hanson. Hata hivyo, Uwekezaji wa mwisho bado haujathibitishwa.

Lotte, Shinsegae and Hyundai Department Store Group have announced their plans to participate in the acquisition. LX Hausys is considered to have the most competitive advantage considering the synergy with Hanson’s business.

With the recent spin-off of LX Group from LG Group, its business scope has expanded from traditional construction materials to the whole house. Building materials account for about 70% ya LX Hausys’ Uuzaji, kufunika windows, milango, sakafu, paneli, artificial marble, na kadhalika. The division’s sales in the second quarter of this year were KRW 659.6 bilioni, juu 25% mwaka hadi mwaka. LX Hausys ina sehemu kubwa zaidi ya soko katika kitengo cha dirisha kwa miradi ya mali isiyohamishika nchini Korea. It also has strengths in high value-added product lines such as marble kitchen sinks and PF insulation materials.

And Hansen has an overwhelming advantage in the Korean retail market. Hansen started with kitchen furniture in 1970, then began supplying interior furniture in 1997 and has expanded its business to include building materials such as bathrooms, Windows na sakafu. It is currently the No. 1 market player in kitchen furniture and interior furniture in Korea. Wafanyabiashara wake wa msingi, quality stores and a number of stores are the most important reasons to attract the acquirer.

Kulingana na ripoti za vyombo vya habari vya Kikorea, Hansen has showrooms and mega experience centers in 15 key locations in the region, including Bangbae-dong, Seocho-gu, Seoul and Nunhyeon-dong, Gangnam-gu, Daegu, Pangyo-dong, and Hanam-si, Korea. They exclusively supply Hansen products and have 550 online stores for re-house remodeling business, 240 kitchen furniture stores and 80 flagship interior design stores.

Hansen employs 8,000 remodeling construction professionals and 2,500 interior design sales associates. Uuzaji wa kampuni mwaka jana (267.5 bilioni alishinda) zaidi ya mara moja kutoka mwaka uliopita (65 bilioni alishinda), the highest performance since its founding. Kituo chake mkondoni, Hansen Mall, ambayo hutoa habari juu ya kubinafsisha nyumba mpya, moving houses, children’s rooms, nk., has achieved positive sales growth since the first quarter of last year. Kwa sasa inavutia 3 wateja milioni kwa mwezi.

Sales of its B2C (remodeling and kitchen) division increased by 23% year-on-year in 2020. Ya hii, Nyumba mpya, which provides total remodeling solutions, ilikua 33.3%. As of 2020, Hansen’s kitchen sales for second-hand homes account for 27.5% of total sales. Combined with 30.6 percent of online and offline sales from the sale of furniture and home furnishings, the B2C business accounted for 69.1 asilimia.

Hansen’s revenue for FY2020

| Data muhimu ya uhasibu | 2020 | 2019 |

| Mapato | 2,067,469 | 1,698,372 |

| Gross Profit | 542,309 | 473,522 |

| Faida ya kufanya kazi | 93,107 | 55,772 |

| Mapato kabla ya ushuru | 95,490 | 74,459 |

| Net Income Growth | 66,841 | 42,715 |

| Ukuaji wa mali jumla | 1,229,510 | 1,202,638 |

| Growth in total liabilities | 600,608 | 589,339 |

| Jumla ya wanahisa | 628,902 | 613,299 |

| Ndefu | 5.3% | 3.6% |

| Roe | 10.4% | 7.0% |

| Total Current Ratio | 118.5% | 117.5% |

| Total Debt Ratio | 95.6% | 96.1% |

| Jumla ya kukopa na vifungo vinavyolipwa | 5.4% | 5.6% |

| Earnings per share | 3,766 | 2,423 |

| Dividend per share | 1,300 | 1,200 |

Kitchen and bathroom information according to public data collation

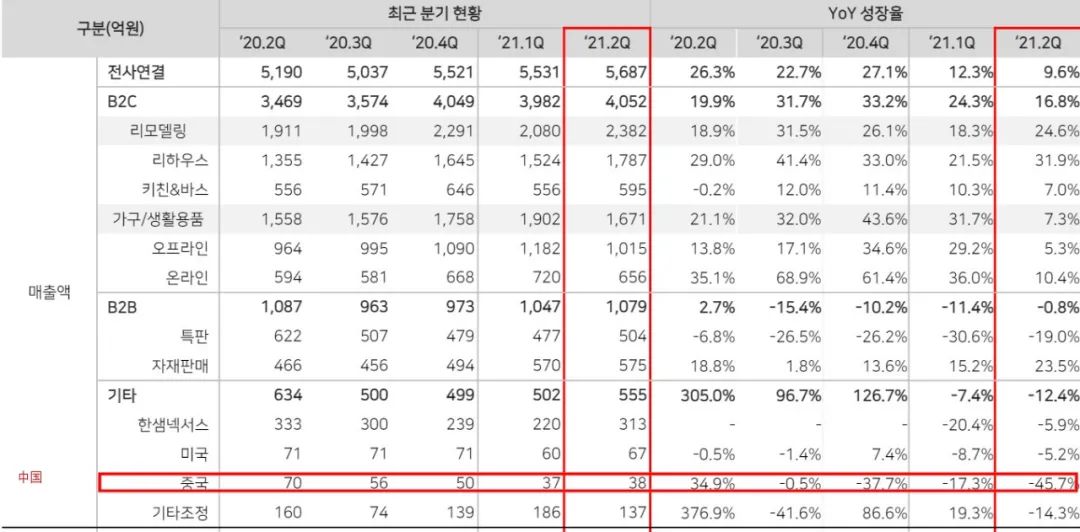

Katika robo ya pili ya 2021, sales and operating profit increased 9.6 percent and 22.6 asilimia, kwa mtiririko huo, compared with the prior year. Remodeling segment sales increased 24.6 Asilimia kwa mwaka.

Hansen 2021 first half results

| Major Accounting Data | '20 .2q | '20 .3q | '20 .4q | 71.1Q | *21.2Q | Increase |

| Uuzaji | 5,190 | 5,037 | 5,521 | 5,531 | 5,687 | +9.6% |

| Faida ya kufanya kazi

Profit before tax |

226 | 237 | 296 | 252 | 277 | +22.6% |

| 4.3% | 4.7% | 5.4% | 4.6% | 4.9% | +0.6%p | |

| Profit and loss for the period

Major Accounting Data |

211 | 266 | 300 | 269 | 321 | +52.1% |

| 4.1% | 5.3% | 5.4% | 4.9% | 5.6% | +1.5%p | |

| Uuzaji | 145 | 190 | 203 | 196 | 243 | +67.6% |

| 2.8% | 3.8% | 3.7% | 3.6% | 4.3% | +1.5%p |

| Channels | '20 .2q | '20 .3q | '20 .4q | 71.1Q | '21 .2q | Increase |

| Remodeling | 1,911 | 1,998 | 2,291 | 2,080 | 2,382 | +24.6% |

| Nyumbani | 1,558 | 1,576 | 1,758 | 1,902 | 1,671 | +7.0% |

| B2B | 1,087 | 963 | 973 | 1,047 | 1,079 | -0.8% |

| Wengine | 634 | 500 | 499 | 502 | 555 | -12.4% |

Kitchen and bathroom information according to public data collation

Pamoja na ukuaji wa ukubwa, Hansen’s overseas subsidiaries did not perform as well as expected. Sales growth at Hansen’s U.S. and China subsidiaries has also slowed each year for the past three years. Mwaka jana, sales at the two subsidiaries declined 10.2 percent and 3.9 asilimia, kwa mtiririko huo, while the China subsidiary experienced a double-digit decline. The decline also continued in the first and second quarters of this year with negative growth of 17.3 percent and 45.7 asilimia.

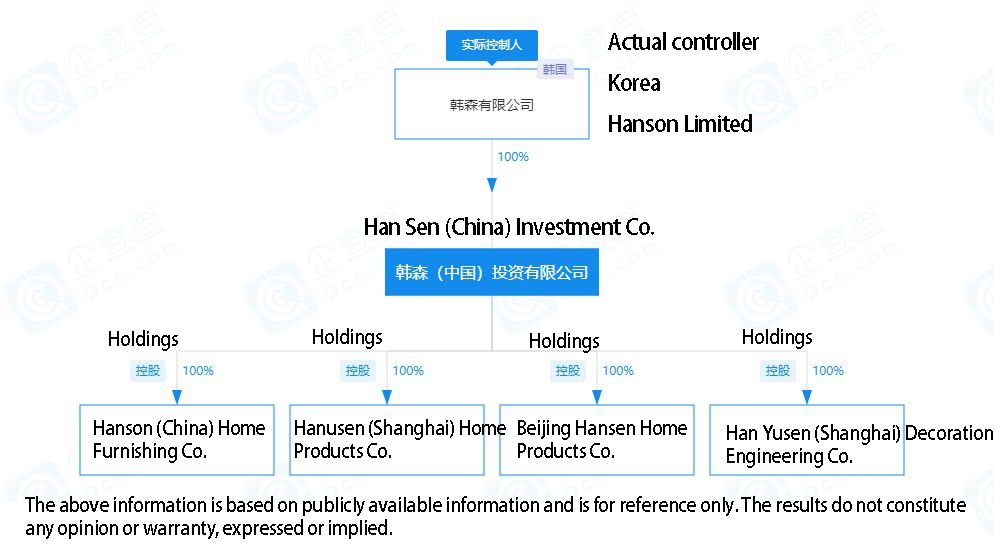

Hansen has been in China since the early 1990s. Katika 1995, it set up Beijing Hansen Home Products Co., Ltd. in Beijing and invested in a cabinet production plant to undertake engineering business, and joint with the head of the pan-home industry to develop some engineering projects.

Kitchen and bathroom information query enterprise search found that the shareholders of Beijing Hansen Home Products Co., Ltd. Hansen (China) Uwekezaji Co., Ltd. increased its registered capital in 2020, but this year Beijing Hansen Home Products Co., Ltd. in February legal representative, wakurugenzi, shareholders and other members of the successive changes.

It is worth noting that earlier this year there were media reports that most of the Korean executives of Hanson Korea stationed in China have been withdrawn one after another at the end of 2018 na mapema 2019. Some of the Chinese employees in China are looking for their next homes, and some have even found their next homes, pending only the arrival of significant layoff compensation.

Mpango uliotangazwa hapo awali wa IMM kupata a 30.21% Haki na haki za usimamizi zinaripotiwa 1.5 trilioni alishinda (RMB 8.3 bilioni).

IMM itakagua Lotte's na LX Hausys’ investments and identify partners as early as mid-September. Kwa sasa, Lotte ametangaza rasmi kuwa ni “Kuzingatia ushiriki” Na LX Hausys ametangaza kuwa itawekeza 300 billion won as a strategic investment. After the acquisition of Hanson is completed, Imm anatarajia kuiendeleza kuwa mwendeshaji mkubwa katika soko la nyumbani la mkondoni na nje ya mkondo.

Muuzaji wa Kiwanda cha Tap iVIGA

Muuzaji wa Kiwanda cha Tap iVIGA