Jikoni asili & Jikoni ya Bafuni & Vichwa vya habari vya Bath

Hivi majuzi, FBHS ilitangaza kuwa imekamilisha ununuzi wa Aqualisa Holdings (baadaye inajulikana kama Aqualisa) kwa $160 milioni (kuhusu RMB 1.080 bilioni). FBHS inamiliki chapa zinazojulikana za bafuni kama vile Moen na ROHL. Katika nusu ya kwanza ya mwaka, biashara yake ya uvumbuzi wa maji ilikuwa na mauzo ya $1.294 bilioni (kuhusu RMB 8.728 bilioni). Upatikanaji huo utaimarisha uwepo wa FBHS kimataifa katika tasnia ya usafi.

Kutumia kuhusu 1.08 bilioni yuan kupata kampuni ya bafuni ya Uingereza

Mnamo Agosti 1, wakati wa ndani, FBHS ilitangaza kwamba imepata Aqualisa, chapa ya bafuni ya Uingereza inayojulikana kwa ubunifu na mifumo ya busara ya kuoga na huduma kwa wateja. Ununuzi huo ulikamilika Julai 29 kwa takriban $160 milioni (takriban RMB 1.080 bilioni).

Nicholas Fink, Mkurugenzi Mtendaji wa FBHS, alisema upatikanaji huo ni mkakati muhimu kwa kampuni katika sekta ya maji. Kama mwanachama wa biashara ya Ubunifu wa Maji, Aqualisa itawezesha kampuni kutoa kasi kubwa katika usimamizi wa maji, bidhaa zilizounganishwa na uendelevu wa kimataifa. Pia, pamoja na upatikanaji wa Aqualisa, FBHS’ Biashara ya Ubunifu wa Maji itapata ufikiaji wa bidhaa za kuoga kidijitali katika viwango vya bei, teknolojia na mikoa, Kuendesha ukuaji zaidi wa biashara.

Nicholas Fink pia alisema kuwa Aqualisa ni nyongeza nzuri kwa chapa za bafuni za kampuni kama vile Moen na ROHL.. Wataongeza uwezo mkubwa wa uuzaji na jukwaa la uvumbuzi wa maji linaloendelea kukua ili kupanua mauzo nchini U.S., U.K. na Ulaya, na kuingia katika masoko mapya katika siku zijazo.

Kwa mujibu wa taarifa za umma, Aqualisa ilianzishwa mwaka 1976 na ni mtengenezaji anayeongoza wa bidhaa za kuoga za akili. Ina sifa kubwa katika soko la Uingereza kwa bidhaa za kuoga zinazotengenezwa na kuuzwa kimsingi chini ya chapa ya Aqualisa.. Kwa sasa, kampuni hiyo ina makao yake makuu huko Westram, Uingereza, na inaajiri kuhusu 260 watu. Kama ilivyoripotiwa hapo awali, Aqualisa alichukua nafasi ya afisa mkuu mtendaji wake muda si mrefu uliopita. Mat Norris amechukua nafasi ya Colin Sykes, ambaye alishika nafasi hiyo tangu hapo 2018. Huyu ataendelea kuhudumu kama mkurugenzi asiye mtendaji na mshauri wa kimkakati kwa kampuni..

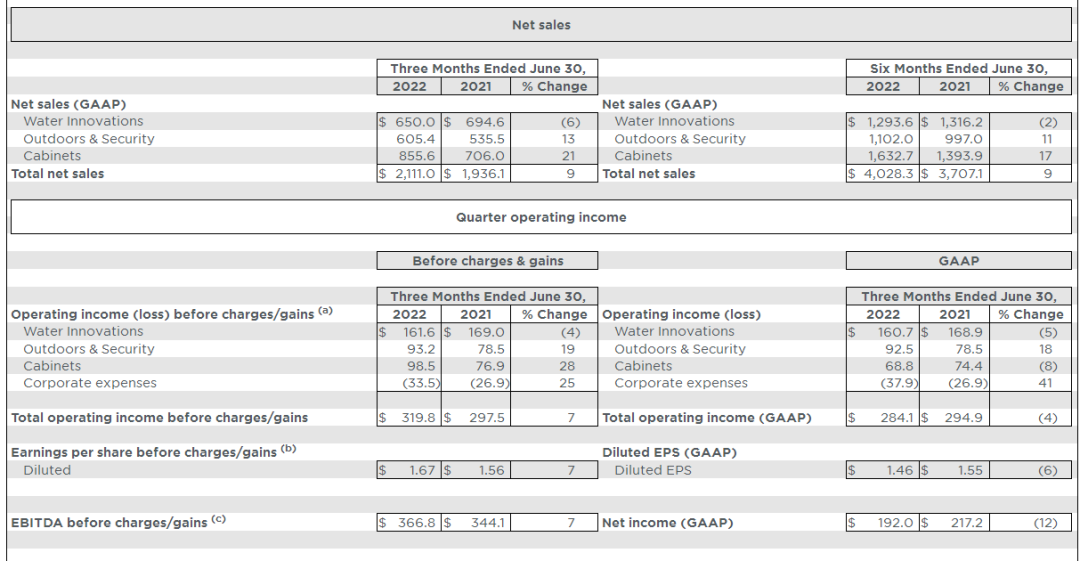

Mauzo ya nusu ya kwanza ya takriban $27.183 bilioni

Kulingana na FBHS H1 iliyotolewa hivi karibuni 2022 ripoti, kampuni ilipata mauzo ya $4.028 bilioni (takriban RMB 27.183 bilioni) Kuanzia Januari hadi Juni, ongezeko la 9% mwaka hadi mwaka. Katika kipindi hicho, FBHS’ EBITDA ilikuwa $373 milioni, a 6% kupungua mwaka hadi mwaka.

Kwa biashara, Katika nusu ya kwanza ya mwaka, mauzo ya FBHS’ biashara ya uvumbuzi wa maji (biashara ya mabomba) walikuwa $1.294 bilioni (takriban RMB 8.728 bilioni), kupungua kwa 2% mwaka hadi mwaka. Uuzaji wa biashara ya baraza la mawaziri, ikiwa ni pamoja na makabati ya bafuni, walikuwa $1.633 bilioni (takriban RMB 11.014 bilioni), ongezeko la 11% mwaka hadi mwaka. Uuzaji wa biashara ya bidhaa za nje na usalama ulikuwa $1.102 bilioni (kuhusu RMB 7.432 bilioni), ongezeko la 17% mwaka hadi mwaka.

Katika ripoti yake ya nusu mwaka, FBHS ilitaja hatua za kurekebisha bei, akisema kuwa ilileta matokeo madhubuti katika robo ya pili kwani mfumuko wa bei ulipunguzwa kikamilifu na bei na hatua zinazohusiana na gharama. Pia walisema kuwa mauzo ya bidhaa za nje na usalama na bidhaa za baraza la mawaziri zote zilikua, inayoendeshwa na hatua hizi. Hata hivyo, mauzo katika biashara ya Ubunifu wa Maji yalipungua 6 asilimia katika robo ya pili kutokana na athari za kuzima kwa ugonjwa huo nchini China, na China inapoondolewa, Uuzaji wa Ubunifu wa Maji ulikuwa na a 4 asilimia ya ukuaji na ukingo wa uendeshaji wa takriban 24.9 asilimia.

Mapitio ya ripoti za kila mwaka za FBHS zilizochapishwa tangu IPO yake inaonyesha kuwa mauzo ya kampuni yameongezeka maradufu 10 miaka. Katika 2011, Uuzaji wa FBHS ulikuwa $3.3 bilioni, na kwa kiasi kikubwa wamedumisha mwelekeo wa ukuaji katika siku za nyuma 10 miaka tangu hapo. Na 2021, Mauzo ya FBHS yamefikiwa $7.7 bilioni, ongezeko la 26% kutoka mwaka uliopita. Kuangalia mbele 2022, FBHS inatarajia ukuaji wa mauzo wa mwaka mzima kubaki katika 6.5% kwa 7.5% mbalimbali. Mapato kwa kila hisa yako katika anuwai ya $6.36 kwa $6.50.

Imepatikana zaidi ya 20 makampuni katika 50 miaka

Kama kampuni kubwa, ingawa FBHS haijulikani sana nchini Uchina kama kampuni tanzu kama vile Moen na ROHL, maendeleo ya kampuni hii ni mfano wa kawaida wa ukuaji wa sekta ya nyumbani kwa njia ya upatikanaji. Inaweza kusemwa kuwa historia ya FBHS ni historia ya ununuzi wa chapa.

Katika 1970, kampuni iliyopata Master Lock, kampuni ya kufuli ya usalama.

Katika 1988, upatikanaji wa Aristokraft na Waterloo

Katika 1990, upatikanaji wa Moen

Katika 1998, iliyopatikana Mapambo, Diamond, Kemper, Schrock

Katika 2002, iliyopatikana Omega

Katika 2003, iliyopatikana Kufuli ya Marekani, Milango ya Therma-Tru

Katika 2007, iliyopatikana Simonton madirisha, Bidhaa za kinu za Fypon

Katika 2011, waliotajwa kwenye Soko la Hisa la New York

Katika 2013, iliyopatikana Wafundi wa mbao

Katika 2014, iliyopatikana Sentrysafe na kuuzwa madirisha ya Simonton

Katika 2015, alipata Nau ufundi, kuuzwa Waterloo

Katika 2016, iliyopatikana Riobel, Perrin & Rowe na kuanzisha Global Plumbing Group (GPG)

Katika 2017, upatikanaji wa Shaws, Victoria + Albert

Katika 2018, upatikanaji wa Fiberoni

Katika 2020, upatikanaji wa Milango ya dhoruba ya Larson

Katika 2022, upatikanaji wa Aqualisa

Muuzaji wa Kiwanda cha Tap iVIGA

Muuzaji wa Kiwanda cha Tap iVIGA