Asl oshxona & Hammom oshxonasi & Hammom sarlavhalari

Yaqinda, FBHS Aqualisa Holdingsni sotib olishni yakunlaganini e'lon qildi (bundan keyin Aqualisa deb yuritiladi) uchun $160 million (RMB haqida 1.080 milliard). FBHS Moen va ROHL kabi taniqli hammom brendlariga ega. Yilning birinchi yarmida, uning suv innovatsion biznesi sotilgan $1.294 milliard (RMB haqida 8.728 milliard). Sotib olish FBHS ning sanitariya sanoatidagi global ishtirokini mustahkamlaydi.

Taxminan sarflash 1.08 milliard yuanga Britaniya hammom kompaniyasini sotib olish uchun

Avgust oyida 1, Mahalliy vaqt, FBHS Aqualisa kompaniyasini sotib olganini e'lon qildi, o'zining innovatsion va aqlli dush tizimlari va mijozlarga xizmat ko'rsatishi bilan mashhur ingliz hammom brendi. Sotib olish iyul oyida yakunlandi 29 taxminan uchun $160 million (taxminan RMB 1.080 milliard).

Nikolas Fink, FBHS bosh direktori, sotib olish suv sektoridagi kompaniya uchun asosiy strategiya ekanligini aytdi. Suv innovatsiyalari biznesining a'zosi sifatida, Aqualisa kompaniyaga suvni boshqarishda kuchli turtki berish imkonini beradi, ulangan mahsulotlar va global barqarorlik. Shuningdek, Aqualisa sotib olish bilan, FBHS’ Suv innovatsion biznesi narx nuqtalarida raqamli dush mahsulotlariga kirish huquqiga ega bo'ladi, texnologiyalar va hududlar, biznesning yanada o'sishiga yordam beradi.

Nikolas Fink shuningdek, Aqualisa kompaniyaning Moen va ROHL kabi hammom brendlariga ajoyib qo'shimcha ekanligini aytdi.. Ular AQShda savdoni kengaytirish uchun kuchli marketing imkoniyatlari va doimiy o'sib borayotgan suv innovatsion platformasidan foydalanadilar., Buyuk Britaniya. va Yevropa, va kelajakda yangi bozorlarga kiring.

Ommaviy ma'lumotlarga ko'ra, Aqualisa yilda tashkil etilgan 1976 va aqlli dush mahsulotlarini ishlab chiqaruvchi yetakchi hisoblanadi. U Buyuk Britaniya bozorida asosan Aqualisa brendi ostida ishlab chiqarilgan va sotiladigan dush mahsulotlari bo'yicha kuchli obro'ga ega.. Hozirda, kompaniyaning shtab-kvartirasi Westramda joylashgan, Uk, va taxminan ishlaydi 260 odamlar. Avval xabar qilinganidek, Aqualisa yaqinda o'zining bosh direktorini almashtirdi. Kolin Sayks o'rniga Met Norris keldi, buyon lavozimni egallab kelgan 2018. Ikkinchisi kompaniyaning ijrochi bo'lmagan direktori va strategik maslahatchisi sifatida xizmat qilishni davom ettiradi..

Birinchi yarim yillik sotuvlar taxminan $27.183 milliard

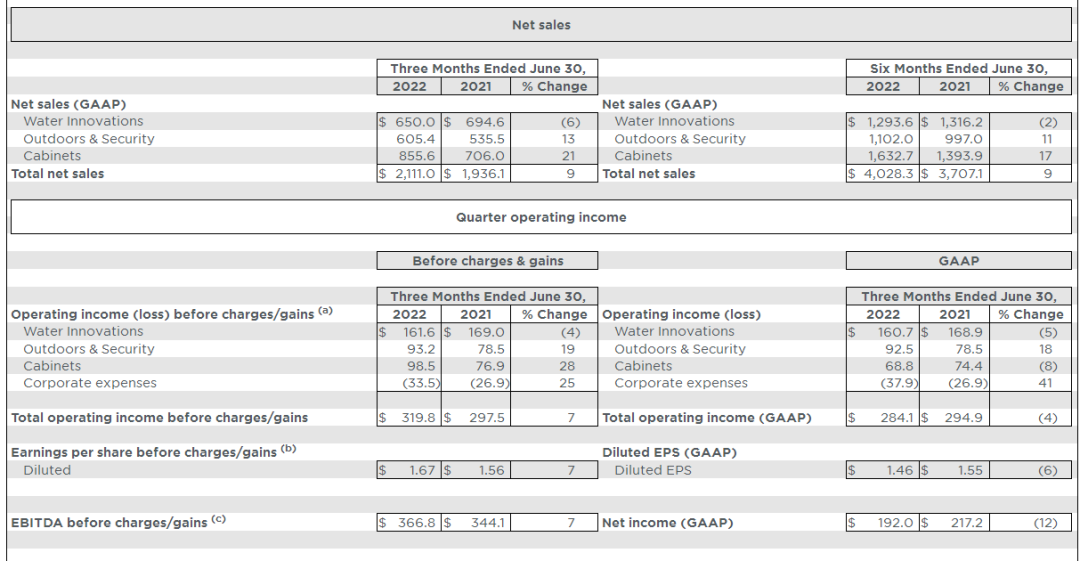

Yaqinda chiqarilgan FBHS H1 ga ko'ra 2022 hisobot, kompaniya sotish hajmiga erishdi $4.028 milliard (taxminan RMB 27.183 milliard) yanvardan iyungacha, ga ortishi 9% yildan yilga. Xuddi shu davrda, FBHS’ EBITDA edi $373 million, a 6% yildan-yilga kamayishi.

Biznes bo'yicha, Yilning birinchi yarmida, FBHS savdosi’ suv innovatsion biznes (sanitariya-tesisat biznesi) edi $1.294 milliard (taxminan RMB 8.728 milliard), pasayish 2% yildan yilga. Kabinet biznesini sotish, hammom kabinetlari, shu jumladan, edi $1.633 milliard (taxminan RMB 11.014 milliard), ga ortishi 11% yildan yilga. Tashqi va xavfsizlik mahsulotlari savdosi bo'ldi $1.102 milliard (RMB haqida 7.432 milliard), ga ortishi 17% yildan yilga.

O'zining yarim yillik hisobotida, FBHS narxlarni sozlash choralarini aytib o'tdi, ikkinchi chorakda kuchli natijalarga erishdi, chunki inflyatsiya narx va xarajatlar bilan bog'liq choralar bilan to'liq qoplandi.. Ular, shuningdek, tashqi va xavfsizlik mahsulotlari va shkaf mahsulotlari savdosi o'sganligini aytishdi, ushbu chora-tadbirlar asosida amalga oshiriladi. Biroq, Suv innovatsiyalari biznesida sotuvlar kamaydi 6 Xitoyda avj olish bilan bog'liq yopilish ta'siri tufayli ikkinchi chorakda foiz, va Xitoy olib tashlanganda, Suv Innovatsiyalar savdosi bor edi 4 foiz o'sish sur'ati va taxminan operatsion marja 24.9 foiz.

FBHSning IPOdan keyin e'lon qilingan yillik hisobotlarini ko'rib chiqish kompaniyaning sotuvi ikki baravar ko'payganini ko'rsatadi 10 yillar. In 2011, FBHS savdolari bo'ldi $3.3 milliard, va asosan o'tmishda o'sish tendentsiyasini saqlab qoldi 10 o'shandan beri yillar. Bilan 2021, FBHS sotuviga erishildi $7.7 milliard, ga ortishi 26% oldingi yildan. Oldinga qarab 2022, FBHS to'liq yillik savdo o'sishi saqlanib qolishini kutmoqda 6.5% uchun 7.5% diapazon. Bir aksiyadan tushgan daromad oralig'ida $6.36 uchun $6.50.

dan ortiq sotib olingan 20 kompaniyalari 50 yillar

Gigant kompaniya sifatida, FBHS Xitoyda Moen va ROHL kabi sho''ba korxonalari kabi yaxshi ma'lum emas, ushbu kompaniyaning rivojlanishi uy sanoatining sotib olish orqali o'sishining odatiy namunasidir. Aytish mumkinki, FBHS tarixi brendni sotib olish tarixidir.

In 1970, kompaniya sotib oldi Master Lock, xavfsizlikni blokirovka qiluvchi kompaniya.

In 1988, sotib olish Aristokraft va Vaterloo

In 1990, sotib olish Moen

In 1998, sotib olingan Dekoratsiya, Olmos, Kemper, Shrok

In 2002, sotib olingan Omega

In 2003, sotib olingan Amerika qulfi, Therma-Tru eshiklari

In 2007, sotib olingan Simonton derazalari, Fypon tegirmon mahsulotlari

In 2011, da sanab o'tilgan Nyu-York fond birjasi

In 2013, sotib olingan Yog'och hunarmandlari

In 2014, sotib olingan Sentrysafe va Simonton oynalarini sotgan

In 2015, sotib olingan Nhunarmandchilik, Waterloo sotilgan

In 2016, sotib olingan Riobel, Perrin & Rowe va Global Plumbing Group tashkil qildi (GPG)

In 2017, sotib olish Shaws, Viktoriya + Albert

In 2018, sotib olish Fiberon

In 2020, sotib olish Larson bo'ron eshiklari

In 2022, sotib olish Aqualisa

iVIGA Tap Factory yetkazib beruvchi

iVIGA Tap Factory yetkazib beruvchi