Original Kitchen And Bathroom Industry Mainstream Media Kitchen And Bathroom News

Supply chain disruptions continue to have a serious impact on material prices, product backlogs, freight costs and kitchen and bathroom project cycles, according to U.S. media reports. While the current situation may be temporary, it is estimated that the situation will continue into next year.

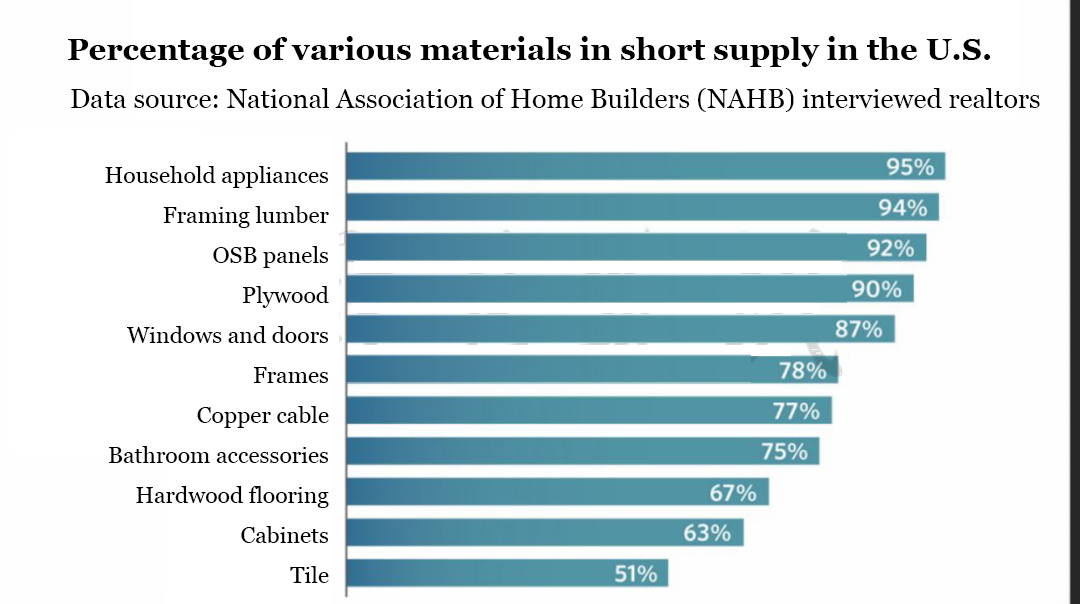

According to the latest survey by the National Association of Home Builders (NAHB), the situation has worsened significantly “dramatically” since this time last year. The impact is broader, including bathroom accessories, household appliances, tile, cabinets, and other key components for manufacturing refrigerators, ovens, dishwashers, microwaves, washers and dryers are in short supply. Among the realtors surveyed, the shortage of bathroom accessories reached 75 ಶೇ. Tile reached 51 ಶೇ. The most serious is household appliances, which reached 95 ಶೇ.

The current shortage of materials is having a wider and deeper impact than at any time since 1990, and rising costs are exacerbating this effect, causing builders’ confidence in the market to fall to its lowest level in a year.

Bathroom suppliers, home decorators, distributors, realtors and others are facing a year-long “storm” of surging demand, coupled with material shortages, logistical challenges and pandemics. While remodeling demand is soaring with increased vaccination rates and a DIY market for homes spawned by emerging lifestyles, supply chain disruptions have led to severe shortages of key building products. Meanwhile, supply constraints have caused material costs to soar.

According to the latest Kitchen and Bath Market Index (hereinafter: KBMI, the U.S. Kitchen and Bath Market Index) compiled by the National Kitchen and Bath Products Association (NKBA), John Burns Real Estate Consulting, supply chain issues coupled with rising material prices and transportation costs are forcing an increasing number of home design firms to face longer lead times while needing to seek alternative sources of supply and raise prices to protect profit margins.

According to the KBMI, the U.S. Kitchen and Bath Market Index for the first quarter of 2021, 45 percent of dealers and designers surveyed said material shortages and product pricing are impacting project lead times. 60 percent of manufacturing facilities surveyed noted average lead times of six weeks or more, a significant increase from the previous quarter. Capacity is being severely constrained by longer raw material lead times and significant freight delays. Meanwhile, 67 percent of realtors surveyed noted that projects have been backlogged for more than three months. And 21% of realtors noted that the backlog will continue until the end of 2021.

Meanwhile, U.S.-based factories are beginning to add capacity and adjust their supply chains. According to reports, in June this year, the U.S. DEVIDA bathroom announced that it will “prioritize” the production of certain brands of products, while suspending production of other series. The company said that this situation is expected to continue until the fourth quarter of 2021. They also noted that while no new orders will be accepted during this period, existing orders are not affected by the decision.

In addition to the United States, Germany is also facing a supply chain disruption crisis. Germany’s Bavarian plumbing and bathroom industry from wood, plastic, steel, brass has also been shortages. In just one year, the price of insulation board has increased by 10%. Flat glass has decreased by 15 ಶೇ, steel has risen by 30 ಶೇ, and roofing panels have increased by 31 ಶೇ. And the global price of copper has risen 80 percent in the past 12 months.

In addition to delivery issues, a shortage of skilled workers is also affecting the construction industry. Recruiting skilled workers, including in China, has become the biggest difficulty in recruiting workers.

iVIGA ಟ್ಯಾಪ್ ಫ್ಯಾಕ್ಟರಿ ಪೂರೈಕೆದಾರ

iVIGA ಟ್ಯಾಪ್ ಫ್ಯಾಕ್ಟರಿ ಪೂರೈಕೆದಾರ