Kitchen And Bathroom Industry Mainstream Media Kitchen And Bathroom Information

This article was integrated by Kitchen & Bath News from bizwatch and ETNEWS

Korea’s offline home camp and online platform camp are competing fiercely for the 18 trillion won (103.3 billion won) indoor market.

According to bizwatch, the pandemic is changing the structure of Korea’s home furnishing industry, with the number of B2C-focused home furnishing companies growing in 2020 with the rise of telecommuting and “home” culture and a tight housing market. On the other hand, the number of B2B-focused home furnishing companies is growing slowly. The industry expects that the focus of the Korean home furnishing market will rapidly shift to B2C in the future.

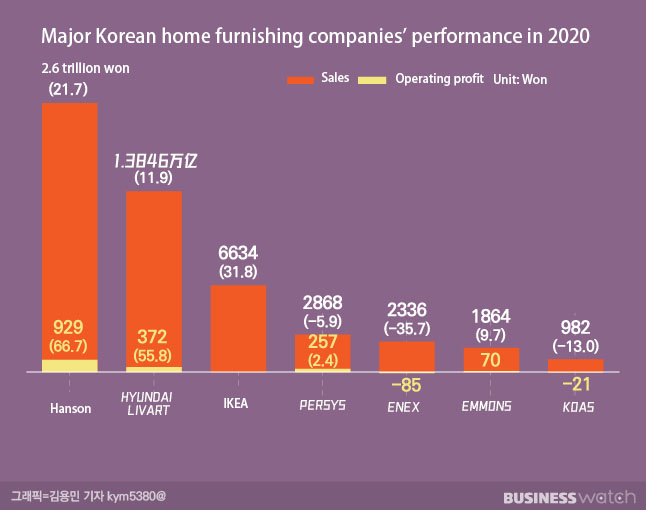

In 2020, Hanssem (Hanssem Home), the top-ranked company in Korea’s home furnishing industry, posted sales of 2.6 trillion won (RMB 14.9 billion), up 21.72% year-on-year. During the same period, operating profit increased 66.7% to 92.9 billion won (RMB 530 million).

Hyundai Livart’s 2020 sales increased 11.9% year-on-year to 1.3846 trillion won (RMB 7.95 billion). Operating profit rose 55.8% to 37.2 billion won (RMB 210 million).

IKEA Korea posted sales of 663.4 billion KRW (RMB 3.0 billion) in the previous fiscal year (September 2019 to September 2020), up 31.8% year-on-year.

Among mid-tier companies, growth was particularly strong at Emmons.co. Emmons posted sales of KRW 186.4 billion last year, up 9.7% from the previous year. Operating profit turned to a profit of 7 billion won.

These companies mainly operate B2C businesses. The highest sales growth rate was at IKEA Korea. The Hanssem “Rehouse” interior business grew 33.2% in sales over the past year. In the same period, sales of Hyundai Livart’s B2C business grew by 11.8%. Sales in the online division, the core of Emmons’ B2C business, increased 29 percent. And growth continued in the first quarter of the year.

Hanssem reported sales of 553.1 billion won and operating profit of 25.2 billion won in the first quarter of this year. This represents a 12.3% and 46.8% increase over the previous year.

Hyundai Livart’s operating profit was 12.5 billion won, down 15.88% over the same period, while B2C sales increased by 4.6%.

On the other hand, B2B-focused home furnishing companies continued to decline in performance. Under the combined impact of the construction recession and the pandemic, ENEX.CO posted sales of 233.6 billion won last year, down 35.7% from the previous year, with an operating loss of 8.5 billion won.

It is expected that the Korean home furnishing market will be restructured around B2C in the future.

According to Statistics Korea, home retail sales in 2020 will be about 10.19 trillion won (RMB 58.48 billion), up 23.8% year-on-year, with e-commerce transactions driving the market’s growth. 5 trillion won (RMB 28.7 billion) of home transactions will be traded in online stores in 2020, up 43.5% from the previous year, accounting for nearly half of the overall retail market.

Hanssem is trying to penetrate beyond the home, and has transferred the function of training interior architecture experts from its Hanssem Service Center to its headquarters. The plan is to increase the number of employees to 3,000 by the end of this year.

At the end of 2020, Hyundai Livart launched “Livart Bath,” a brand that specializes in bathroom remodeling, from sales and construction to after-sales management.

The overall size of the Korean home furnishing market is currently 13.7 trillion won (RMB 78.62 billion) and is expected to reach 18 trillion won (RMB 103.3 billion) by 2023, with an average annual growth rate of 15%.

South Korea has maintained an annual per capita income of USD 30,000 (CNY 190,000) since 2017. In this context, analysis suggests that the pandemic has acted as a catalyst, shortening the time needed to expand the market, and the B2C home market is expected to grow even faster in the future. According to Korean media, the Korean home interior market is expected to continue to grow structurally as lifestyles centered on the home space continue to change.

iVIGA Tap Factory Supplier

iVIGA Tap Factory Supplier