According to inbusiness.kz, Kazakhstan produces 586 billion tenges (RMB 8.88 billion) of building materials domestically and has imported 348 billion tenges (RMB 5.27 billion).

Almaty, Kazakhstan

The current market demand for basic construction materials in the country is 934 billion tenges (RMB 14.16 billion). Local companies produce 586 billion tenges (RMB 8.88 billion). It imports production of 348 billion tenges (RMB 5.27 billion), with a 37% share of imports.

There Are No Sanitary Ware Factories In Kazakhstan

To meet market demand, this year Kazakhstan plans to launch eight projects for import substitution. They plan to produce five categories of building materials, including glass, polyethylene pipes, dry mixes, fittings, and tiles, with an expected output of 103 billion tenges. The production of building materials such as insulation materials, ceramic refractory bricks, and sanitary ware is planned, with an estimated output of 61 billion tenges.

The local building materials categories are concentrated in 24 categories such as reinforced concrete products, dry mixes, waterproofing, wall paper, sanitary ware, wall blocks, insulated bricks, profiled panels, plastic pipes, etc. The existing local production capacity has covered 10 categories of products such as reinforced concrete products, varnish coatings, ceramic bricks, silicate bricks, cellular concrete blocks, and glass.

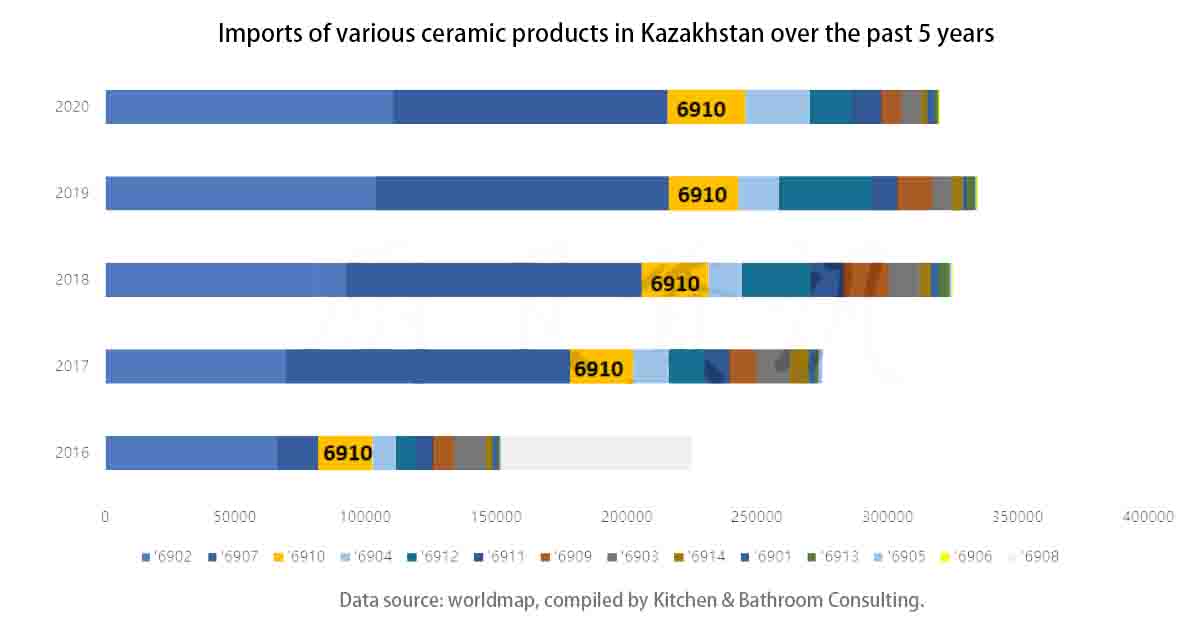

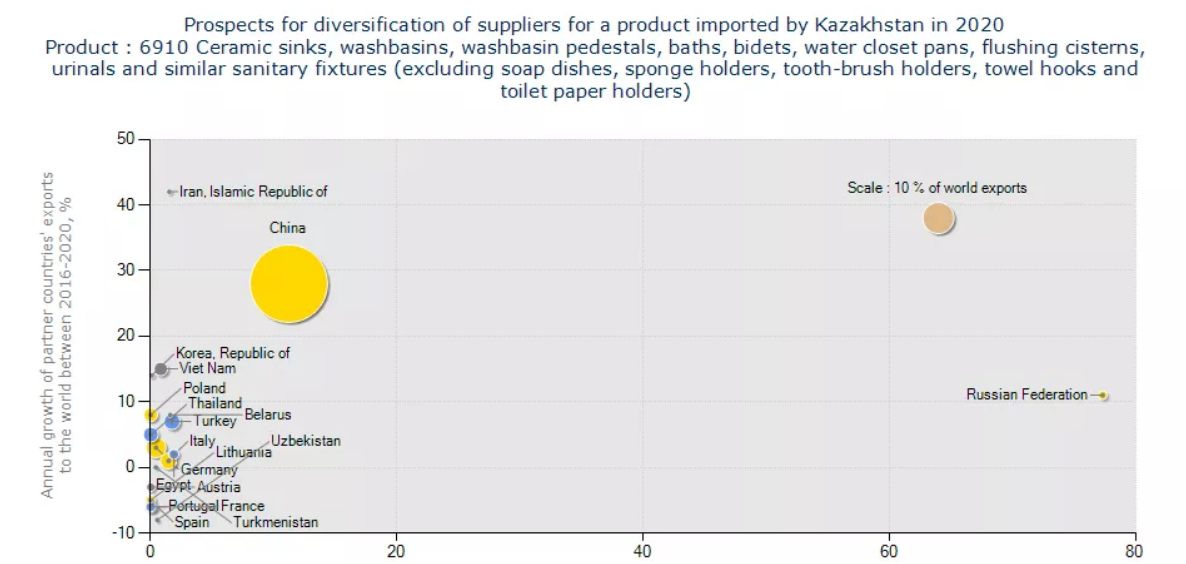

For 11 categories such as insulation materials, profiled panels, and plastic pipes, local enterprise capacity can only provide a 50% supply. For 3 categories such as waterproofing, wallpaper, and sanitary ware, the local production capacity was 0. The supply of local sanitary ware was mainly based on imports. According to the data obtained from Kitchen & Bath, from 2016 to 2020, Kazakhstan’s imports of sanitary ware (6910) are US$20,979,000, US$24,264,000, US$25,738,000, US$26,669,000 and US$29,683,000 respectively. China is the largest source country for Kazakhstan’s sanitary ware imports. In 2018-2020, China’s exports of sanitary ceramics (6910) to Kazakhstan amounted to USD 2,419 thousand, USD 2,593 thousand, USD 3,342 thousand respectively.

From January to June this year, China’s 6910 sanitary ceramics exports to Kazakhstan were US$2.94 million, an increase of 14% year-on-year. in 2020, a decrease of 47% compared to 2019. Among them, Xinjiang region for three six-month export share of the largest region, followed by Guangdong, Shandong, Zhejiang.

| Customs Code | Chinese exports to Kazakhstan | China exports to the world | World exports to Kazakhstan | ||||||

| Amount for 2018 | Amount for 2019 | Amount for 2020 | Amount for 2018 | Amount for 2019 | Amount for 2020 | Amount for 2018 | Amount for 2019 | Amount for 2020 | |

| ,6902 | 32400 | 24256 | 20825 | 1880648 | 1604198 | 1243912 | 92644 | 103922 | 110453 |

| ,6907 | 24954 | 23064 | 17741 | 4436260 | 4555308 | 4111152 | 113057 | 112402 | 105547 |

| ,6912 | 25564 | 33995 | 14217 | 492723 | 477929 | 505401 | 26755 | 35328 | 16033 |

| ,6911 | 8263 | 5244 | 6202 | 5844579 | 6519214 | 5696597 | 12293 | 10160 | 11531 |

| *6909 | 7857 | 6662 | 5416 | 654350 | 669487 | 635107 | 17510 | 13204 | 7580 |

| *6910 | 2419 | 2593 | 3342 | 5878022 | 7984884 | 8756132 | 25738 | 26669 | 29683 |

| ,6903 | 5161 | 2613 | 1744 | 281294 | 291300 | 268898 | 11929 | 7789 | 7258 |

| *6913 | 3214 | 2904 | 926 | 1605945 | 1697600 | 1602113 | 4098 | 3551 | 1407 |

| ,6914 | 97 | 255 | 342 | 658109 | 844957 | 1291231 | 3936 | 4107 | 2687 |

| ,6901 | 1318 | 38 | 330 | 37240 | 49035 | 48083 | 3069 | 1288 | 2567 |

| ,6904 | 7 | 138 | 113 | 531177 | 652191 | 880021 | 12672 | 15467 | 24652 |

| ,6906 | 1 | 1 | 50 | 14363 | 14722 | 13163 | 19 | 49 | 64 |

| ,6905 | 838 | 50 | 0 | 55234 | 72168 | 64799 | 887 | 150 | 105 |

Data source: worldmap, Kitchen & Bath

| Province | Export value (US$) | |

| 1 | Xinjiang | 3749958 |

| 2 | Guangdong | 3500167 |

| 3 | Shandong | 930686 |

| 4 | Zhejiang | 716492 |

| 5 | Hebei | 337240 |

| 6 | Fujian Province | 333002 |

| 7 | Hunan | 248093 |

| 8 | Jiangxi | 241480 |

| 9 | Sichuan | 81175 |

| 10 | Tianjin | 62,407 |

| 11 | Gansu | 56350 |

| 12 | Guangxi | 36949 |

| 13 | Hubei | 20060 |

| 14 | Jiangsu | 18457 |

| 15 | Henan Province | 16650 |

| 16 | Beijing | 8835 |

| 17 | Anhui Province | 1822 |

| 18 | Chongqing | 580 |

Data source: China Customs, Kitchen & Bath

| #

|

International brands entering Kazakhstan |

| 1 | Zehnder |

| 2 | Vismara Vetro |

| 3 | Villeroy&Boch |

| 4 | Viega |

| 5 | THG |

| 6 | Roca |

| 7 | Redblu by Damixa |

| 8 | Radaway |

| 9 | Paa |

| 10 | Olympia Ceramica |

| 11 | Oasis |

| 12 | Nicol |

| 13 | MCH |

| 14 | Laufen |

| 15 | La tor re |

| 16 | Knief |

| 17 | Keuco |

| 18 | Kaldewei |

| 19 | Jacob Delafon |

| 20 | Ideal Standard |

| 21 | Huppe |

| 22 | Hidra Ceramica |

| 23 | HansGrohe |

| 24 | Grohe |

| 25 | Geberit |

| 26 | Fiori |

| 27 | Dornbracht |

| 28 | Damixa |

| 29 | Colombo |

| 30 | Ardesto |

| 31 | Aqwella |

| 32 | AM.PM |

| 33 | AlcaPlast |

| Kitchen and bathroom information collated | |

The local imports of high-end brands are mainly European regional brands.

In order to increase the production capacity of local sanitary ware, the country also plans to coordinate with multinational companies to build factories on the ground. According to Kazakh media reports, the capital will invest in a number of building materials factories in the Kazakh capital, including a ceramic tile factory and a sanitary ware factory. Among them, the ceramic tile plant is planned to have a capacity of 120 million ceramic tiles per year, which can produce ordinary ceramic tiles and decorative ceramic tiles. The other project is for the production of upholstered furniture and cabinets and doors. The planned annual production capacity is about 24,000 sets of upholstered furniture and cabinets and 2,000 sets of interior doors per month.

It is worth noting that part of the local industry has become an oligopolistic market with a higher reliance on imports (the share of imports amounts to 65%). In June this year, in order to curb the rise in local prices, the Kazakhstan government signed an anti-monopoly compliance agreement with 10 building material producers. They regulated building materials such as bricks and pipes in some areas and required that the increase should not exceed 10%.

iVIGA Tap Factory Supplier

iVIGA Tap Factory Supplier