Original Kitchen And Bathroom Industry Mainstream Media Kitchen And Bathroom Information

The acquisition war for Korea’s largest home furnishing company is heating up.

With the addition of Korean retail giant, LX Group, the competition for the acquisition of Hanson Home is intensifying. Previously, South Korea’s Shinsegae Department Store, Hyundai Furniture (Hyundai Livart), a subsidiary of Hyundai Department Store, and South Korea’s Lotte announced their intention to jointly acquire Hanson with South Korea’s private equity IMM PrivateEquity (IMM). But the acquisition camp is expanding with the addition of LXHausys, a building materials company owned by LX Group (once part of LG), one of Korea’s top 50 corporate groups.

If LX Hausys acquires Hansen, the top-ranked company in the interior design and building materials industry, the landscape of the Korean building materials and interior design industry will undergo a huge shakeup, and the market shares of the top companies will be recalculated.

According to Korean media, LX Hausys held a board meeting on September 6 and announced that it will invest 300 billion won (RMB 1.7 billion) as a strategic investor in a private equity fund that IMM plans to set up to acquire Hanson. However, the final investment has not yet been confirmed.

Lotte, Shinsegae and Hyundai Department Store Group have announced their plans to participate in the acquisition. LX Hausys is considered to have the most competitive advantage considering the synergy with Hanson’s business.

With the recent spin-off of LX Group from LG Group, its business scope has expanded from traditional construction materials to the whole house. Building materials account for about 70% of LX Hausys’ sales, covering windows, doors, flooring, panels, artificial marble, etc. The division’s sales in the second quarter of this year were KRW 659.6 billion, up 25% year-on-year. LX Hausys has the largest market share in the window category for real estate projects in Korea. It also has strengths in high value-added product lines such as marble kitchen sinks and PF insulation materials.

And Hansen has an overwhelming advantage in the Korean retail market. Hansen started with kitchen furniture in 1970, then began supplying interior furniture in 1997 and has expanded its business to include building materials such as bathrooms, windows and flooring. It is currently the No. 1 market player in kitchen furniture and interior furniture in Korea. Its core dealers, quality stores and a number of stores are the most important reasons to attract the acquirer.

According to Korean media reports, Hansen has showrooms and mega experience centers in 15 key locations in the region, including Bangbae-dong, Seocho-gu, Seoul and Nunhyeon-dong, Gangnam-gu, Daegu, Pangyo-dong, and Hanam-si, Korea. They exclusively supply Hansen products and have 550 online stores for re-house remodeling business, 240 kitchen furniture stores and 80 flagship interior design stores.

Hansen employs 8,000 remodeling construction professionals and 2,500 interior design sales associates. The company’s sales last year (267.5 billion won) more than quadrupled from the previous year (65 billion won), the highest performance since its founding. Its online channel, Hansen Mall, which provides information on customizing new homes, moving houses, children’s rooms, etc., has achieved positive sales growth since the first quarter of last year. It currently attracts 3 million customers per month.

Sales of its B2C (remodeling and kitchen) division increased by 23% year-on-year in 2020. Of this, Re-House, which provides total remodeling solutions, grew by 33.3%. As of 2020, Hansen’s kitchen sales for second-hand homes account for 27.5% of total sales. Combined with 30.6 percent of online and offline sales from the sale of furniture and home furnishings, the B2C business accounted for 69.1 percent.

Hansen’s revenue for FY2020

| Key Accounting Data | 2020 | 2019 |

| Revenue | 2,067,469 | 1,698,372 |

| Gross Profit | 542,309 | 473,522 |

| Operating profit | 93,107 | 55,772 |

| Income before tax | 95,490 | 74,459 |

| Net Income Growth | 66,841 | 42,715 |

| Growth in total assets | 1,229,510 | 1,202,638 |

| Growth in total liabilities | 600,608 | 589,339 |

| Total number of shareholders | 628,902 | 613,299 |

| ROA | 5.3% | 3.6% |

| ROE | 10.4% | 7.0% |

| Total Current Ratio | 118.5% | 117.5% |

| Total Debt Ratio | 95.6% | 96.1% |

| Total borrowings and bonds payable | 5.4% | 5.6% |

| Earnings per share | 3,766 | 2,423 |

| Dividend per share | 1,300 | 1,200 |

Kitchen and bathroom information according to public data collation

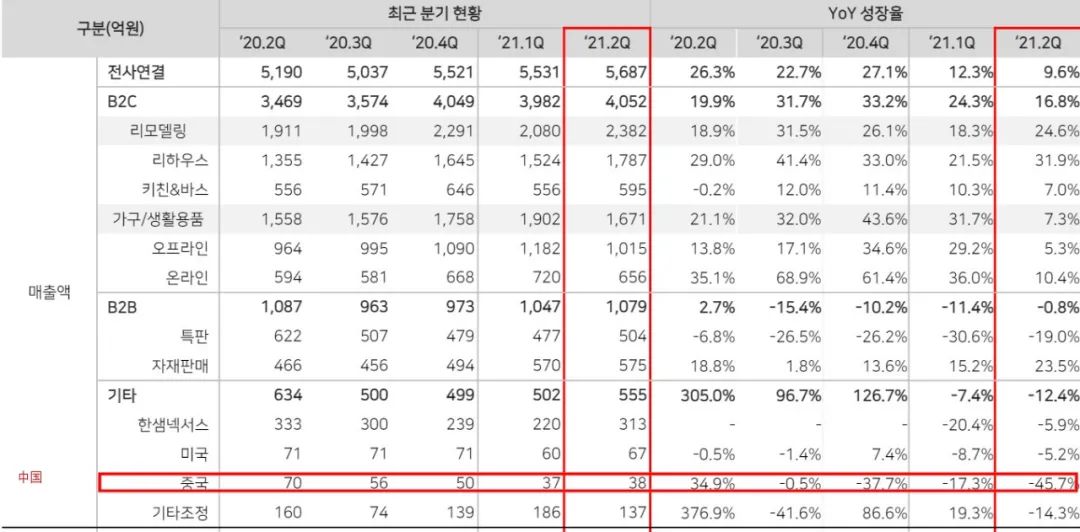

In the second quarter of 2021, sales and operating profit increased 9.6 percent and 22.6 percent, respectively, compared with the prior year. Remodeling segment sales increased 24.6 percent year-over-year.

Hansen 2021 first half results

| Major Accounting Data | ‘20.2Q | ‘20.3Q | ‘20.4Q | 71.1Q | *21.2Q | Increase |

| Sales | 5,190 | 5,037 | 5,521 | 5,531 | 5,687 | +9.6% |

| Operating profit

Profit before tax |

226 | 237 | 296 | 252 | 277 | +22.6% |

| 4.3% | 4.7% | 5.4% | 4.6% | 4.9% | +0.6%p | |

| Profit and loss for the period

Major Accounting Data |

211 | 266 | 300 | 269 | 321 | +52.1% |

| 4.1% | 5.3% | 5.4% | 4.9% | 5.6% | +1.5%p | |

| Sales | 145 | 190 | 203 | 196 | 243 | +67.6% |

| 2.8% | 3.8% | 3.7% | 3.6% | 4.3% | +1.5%p |

| Channels | ‘20.2Q | ‘20.3Q | ‘20.4Q | 71.1Q | ‘21.2Q | Increase |

| Remodeling | 1,911 | 1,998 | 2,291 | 2,080 | 2,382 | +24.6% |

| Home | 1,558 | 1,576 | 1,758 | 1,902 | 1,671 | +7.0% |

| B2B | 1,087 | 963 | 973 | 1,047 | 1,079 | -0.8% |

| Others | 634 | 500 | 499 | 502 | 555 | -12.4% |

Kitchen and bathroom information according to public data collation

Despite the growth in size, Hansen’s overseas subsidiaries did not perform as well as expected. Sales growth at Hansen’s U.S. and China subsidiaries has also slowed each year for the past three years. Last year, sales at the two subsidiaries declined 10.2 percent and 3.9 percent, respectively, while the China subsidiary experienced a double-digit decline. The decline also continued in the first and second quarters of this year with negative growth of 17.3 percent and 45.7 percent.

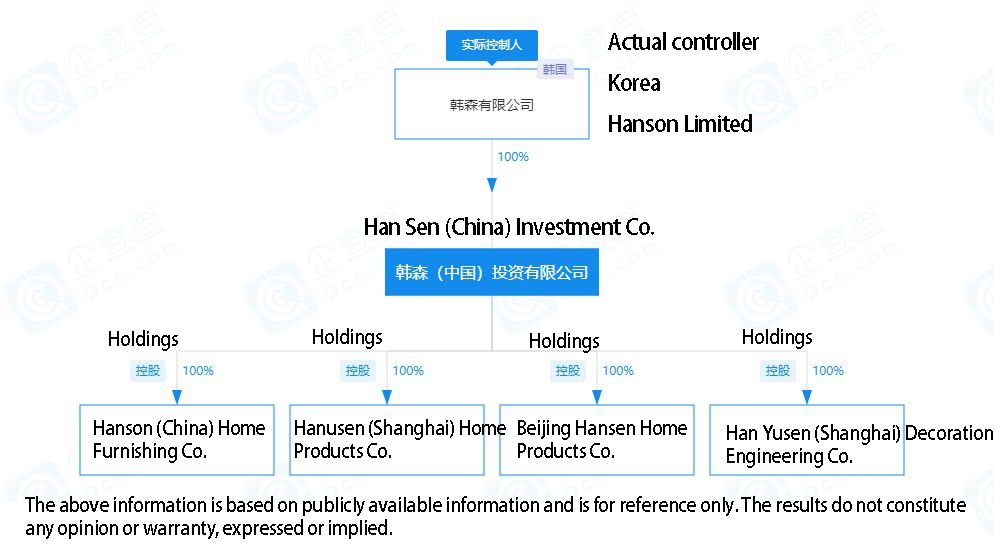

Hansen has been in China since the early 1990s. In 1995, it set up Beijing Hansen Home Products Co., Ltd. in Beijing and invested in a cabinet production plant to undertake engineering business, and joint with the head of the pan-home industry to develop some engineering projects.

Kitchen and bathroom information query enterprise search found that the shareholders of Beijing Hansen Home Products Co., Ltd. Hansen (China) Investment Co., Ltd. increased its registered capital in 2020, but this year Beijing Hansen Home Products Co., Ltd. in February legal representative, directors, shareholders and other members of the successive changes.

It is worth noting that earlier this year there were media reports that most of the Korean executives of Hanson Korea stationed in China have been withdrawn one after another at the end of 2018 and early 2019. Some of the Chinese employees in China are looking for their next homes, and some have even found their next homes, pending only the arrival of significant layoff compensation.

The previously announced deal for IMM to acquire a 30.21% stake and management rights is reportedly worth 1.5 trillion won (RMB 8.3 billion).

IMM will review Lotte’s and LX Hausys’ investments and identify partners as early as mid-September. Currently, Lotte has officially announced that it is “considering participation” and LX Hausys has announced that it will invest 300 billion won as a strategic investment. After the acquisition of Hanson is completed, IMM expects to develop it into the largest operator in the online and offline indoor home market.

iVIGA Tap Factory Supplier

iVIGA Tap Factory Supplier